IG Private Credit – Shifting Benefits up the Risk Spectrum

Private credit has been one of the fastest-growing segments of the financial system over the past 16 years. The asset class, as commonly measured, totaled nearly $2 trillion by the end of 2024. While it remains a small fraction of the broader fixed-income landscape, it is growing – as a share of US debt outstanding, private credit jumped from 1.7% in 2003 to 6.6% in 2023. Why? These private financing solutions continue to compare favorably against bank and public alternatives. Thirty years ago, companies would work with banks to access financing – as those solutions became more commoditized, private credit stepped in to offer a unique partnership and bespoke financing solutions tailored to specific borrower needs. Borrowers’ willingness to pay a premium to comparable publics for the speed and certainty of execution, unregistered status (particularly important for cross-border issuers), and customizable structures were promptly met by yield-hungry lenders.

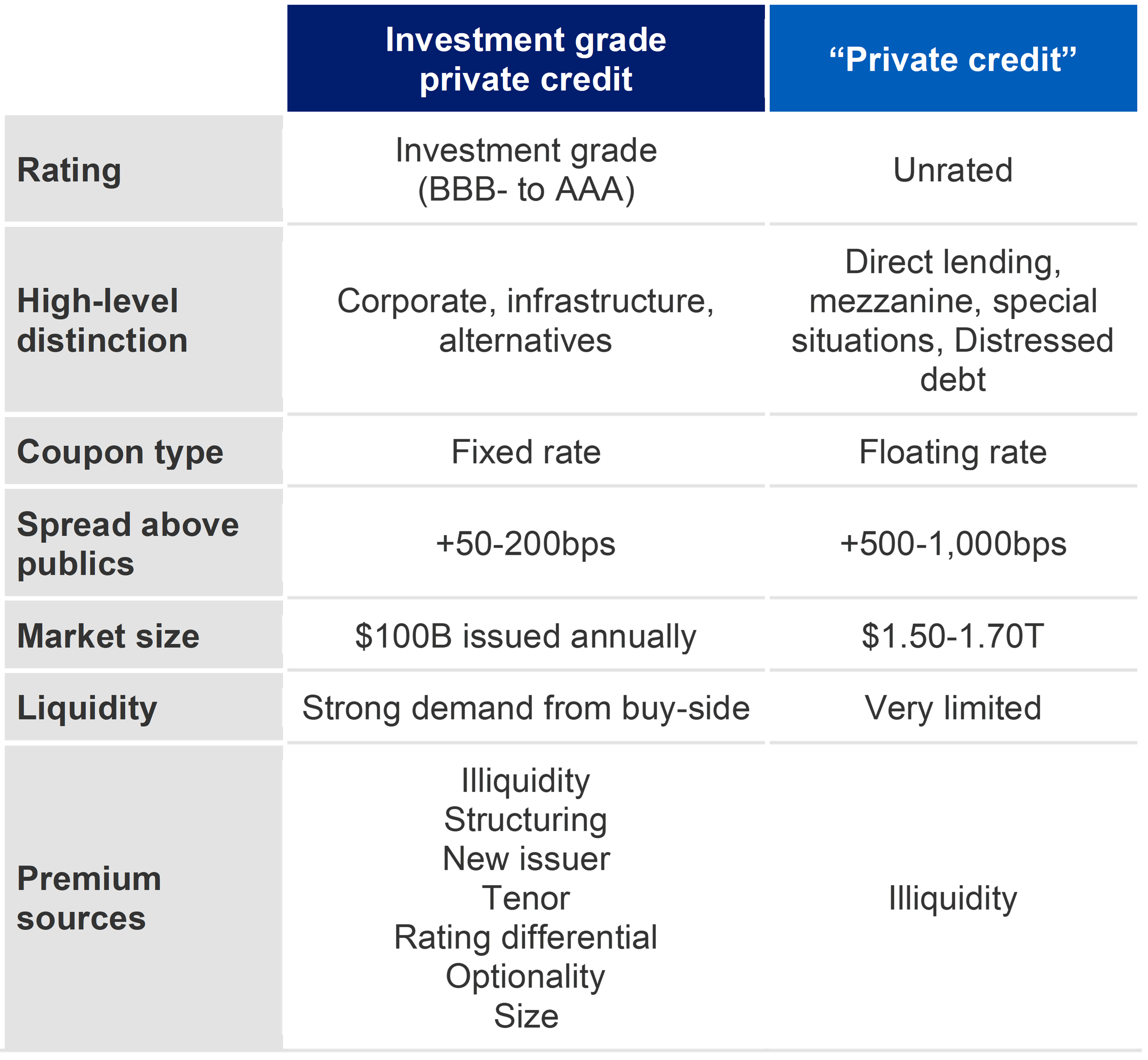

Much of private credit’s growth to date has been concentrated in direct lending – and as AUM has ballooned, it has captured a lot of headlines around excessive risk taking under the name of “private credit.” Thus, many of the broad characteristics assigned to private credit are features of direct lending – sub-investment grade rating, floating rate obligations and most notably, illiquidity.

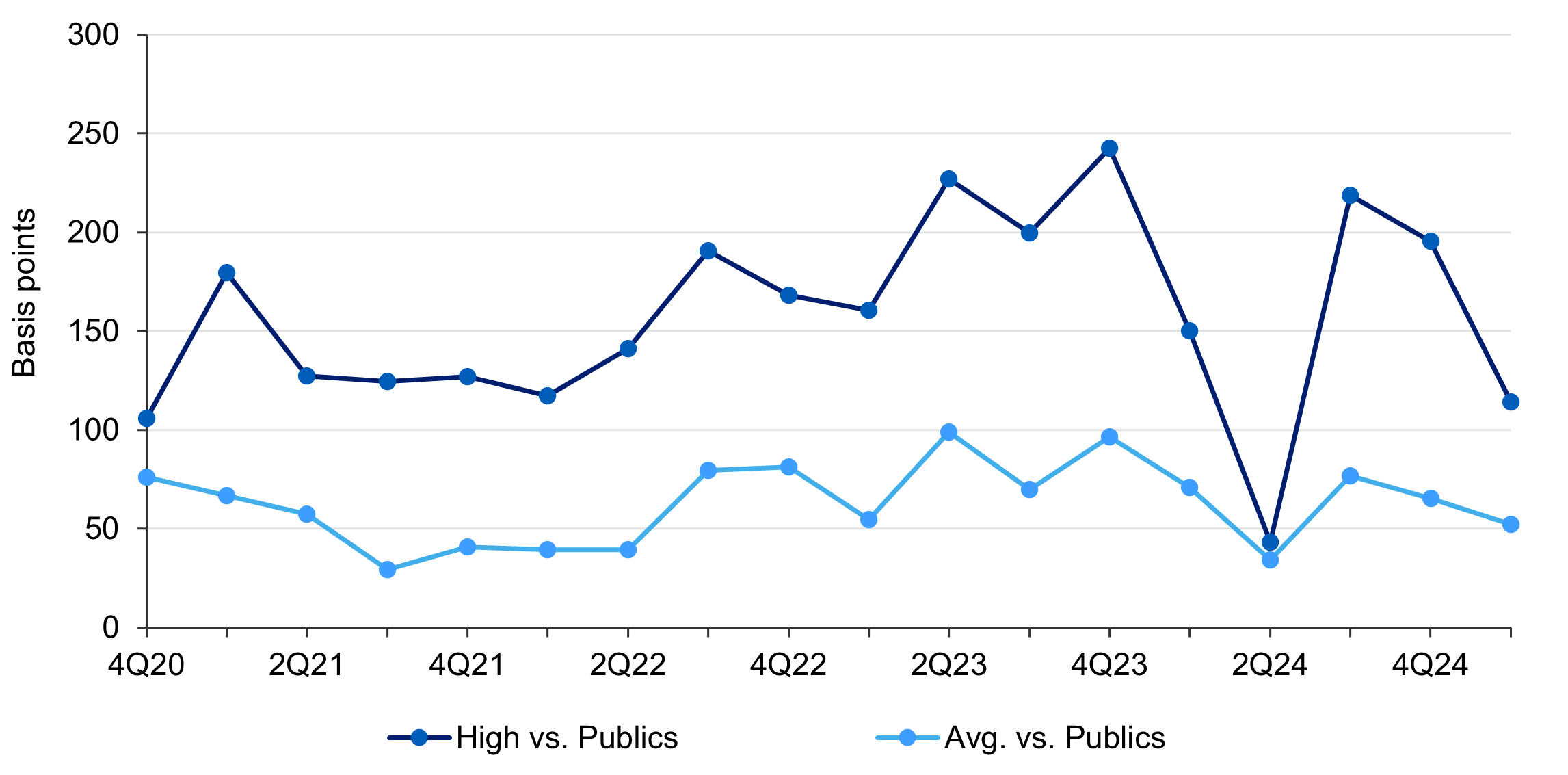

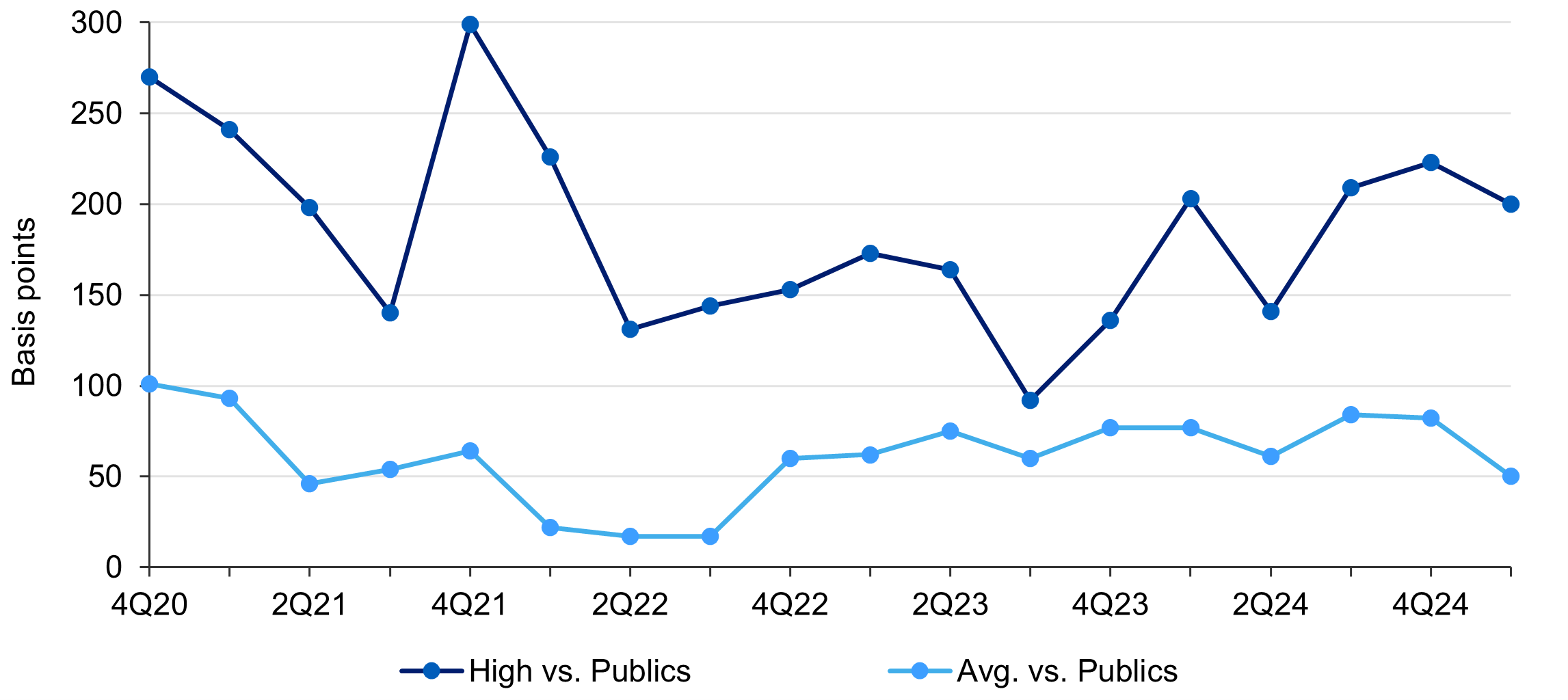

Investment grade (IG) private credit, an often overlooked $200 billion segment of the asset class, carries meaningfully different characteristics. While still benefiting from the issuer preferences of execution and customization, the asset class also offers stronger covenant packages compared to publics. These features drive a meaningful portion of the spread premium received relative to public credit equivalents, suggesting a “complexity” premium where investors are required to navigate several additional factors not present in public markets (Figure 1, 2 and 3).

Figure 1: IG Private Credit versus Private Credit

Source: LGIM America. For illustrative purposes only. IG private credit segment can be synonymous with private placements whose market is ~90% investment grade.

In addition to execution and customization, privacy can also play a major role in the willingness to pay a private market premium. The incredibly well capitalized National Football League (NFL) is one of the largest borrowers in the IG market. The NFL’s preference for borrowing from private markets is also influenced by their desire to maintain financial privacy. Unlike public markets, which require extensive disclosures and adherence to SEC regulations, private credit allows the NFL to keep its financial details confidential. This discretion is particularly valuable for the NFL and more than justifies a premium to public comparables.

Standardized vs. black-box ratings

Aside from being fixed rate and meaningfully more liquid than sub-IG counterparts, IG private credit markets benefit from a mostly uniform ratings methodology akin to public markets. As many market participants are beginning to realize, the broader conversation around private credit has focused on high-level distinctions such as direct lending rather than ratings distinctions in-line with public market convention. But this evolution makes sense – early users of the market were more levered companies who could not land favorable terms with their banking relationships.

However, most of the market has continued its evolution towards manager preferences as opposed to industry standards. To date, many managers focus more on their internal ratings or risk/reward trade-off assessments. They frequently try to take the public ratings out of the analysis and focus on a more flexible internal rating criteria and/or measure risk as leverage per unit of spread or return per unit of leverage.

Major opportunity in the IG segment

Historically, IG private credit has been a favored investment for US insurance companies seeking diversification through unlisted, high-quality debt assets. While this market segment has been outpaced by direct lending, investors are starting to identify a massive opportunity in high-grade debt. This is timely, as diversification in high-quality assets has become increasingly important with public indices becoming more and more concentrated.

Currently, there is a tremendous appetite for capital. We talk about the “Global Industrial Renaissance”– data and compute, power for AI, energy transition – which suggests the real economy needs massive amounts of capital. Some managers view private credit as a $40 trillion market, a majority of which is investment grade. McKinsey ran a similar analysis and found “the addressable market for credit could be more than $30 trillion in the United States alone.”

Some of biggest public capital market participants are looking for diversified financing, flexibility and high-quality partners who can bring speed and certainty such as Anheuser-Busch Inbev SA, Intel and Air France. These are IG, name brand firms with plentiful access to public markets yet turn to the private markets looking for differentiated solutions. Continued bank retrenchment has fueled private issuance while investors have responded with meaningful demand – first-quarter 2025 saw a 38% year-over-year increase in issuance with deals “very” oversubscribed. Notably, 30% of the volume was from new issuers.

Shifting private credit benefits up the risk spectrum

From a niche allocation idea to a core portfolio holding for global insurers of all stripes, the IG private credit asset class has swiftly evolved. And as pension plan funding ratios have meaningfully increased, plans are starting to look more like the diversified insurance portfolios. In a recent Nuveen survey of 300+ respondents, 52% of institutional investors intend to increase their allocation to IG private credit in the next twelve months.

Potential for enhanced return, greater diversification and built-in structural protections have fueled the demand from investors. With public spreads at historical tights, IG private credit remains a highly favored arena for additional spread from highly rated assets. Additionally, exposures in public indexes continue to compress inherently reducing diversification in unsecured assets. We expect investor demand to increase alongside supply supporting attractive spread premiums while the new issuers entering the market will further enhance the effects of diversification.

And the opportunity set is only expanding – take the Alternatives / Asset-Based financing space, where investors are gaining access to increasingly diverse and non-cyclical cash-flow streams. Recent growth in areas like data center receivables, residential solar loans and equipment finance illustrates how IG private credit continues to push beyond traditional corporate issuance. At the same time, Alternative segments like NAV-based lending, CTLs and insurance-linked notes are opening new channels for deployment – often with structural protections unavailable in public markets. This continued evolution reinforces IG private credit not just as a complement to public credit, but as a dynamic source of return, diversification and principal protection.

Figure 2: NAIC-1 Spreads (A-AAA) versus public comparables

Source: BAML – public index references ICE BAML corporate indices (blend of C0A1/2/3 to align with NAIC-1 & C0A4 aligned with NAIC-2) as of March 31, 2025. NAIC: National Association of Insurance Commissioners.

Figure 3: NAIC-2 Spreads (BBB) versus public comparables

Source: BAML – public index references ICE BAML corporate indices (blend of C0A1/2/3 to align with NAIC-1 & C0A4 aligned with NAIC-2) as of March 31, 2025. NAIC: National Association of Insurance Commissioners.

Disclosures

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, L&G – Asset Management, America has not independently verified such information, nor does it assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. L&G – Asset Management, America’s opinions and estimates constitute L&G – Asset Management, America’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.