Amid Global Uncertainty, What Role Can EMD Play in Insurance Portfolios?

What potential benefits could it offer insurers—and what considerations do they need to take into account?

The high degree of recent policy volatility has led to huge uncertainty for market participants. Given their significant exposure to tariff risk, certain emerging markets could face a meaningful economic impact in various possible scenarios.

In recent years, emerging market debt (EMD) has become a fixture in insurance general account portfolios, with investors drawn in by the possibility of a capital-adjusted return pickup and potential diversification benefits. It can also fit well into insurers’ asset liability management (ALM), providing contractual cash flows to match liabilities and manage accounting volatility.

However, as ever with insurers, it is not a case of one-size-fits-all. Below we’ll explore three parts of the insurance general account where EMD features and share our thoughts on three actions we think could benefit insurers under present conditions.

1. Life insurer matching portfolio

Life insurers matching portfolios typically invest for the long term to match long-duration liability cash flows, aiming to avoid defaults and minimize downgrades to sub-investment grade (IG), thereby retaining prudence in reserves and generating operating profit.

Historically, EMD was not a mainstream choice for life insurers' matching portfolios due to its generally sub-IG credit quality and short duration. However, as EMD markets have developed and credit quality has improved, insurers are increasingly investing in sleeves of long-duration investment grade EMD alongside IG developed market (IG DM) credit.

Life insurers have been attracted by the potential return pickup (we have built portfolios at 60+ basis points (bps) over broadly rating- and duration-equivalent DM credit), potential diversification benefits, and the ability to construct long-duration portfolios—we have helped our insurance clients to build diversified EM sleeves with durations of 10 or more years.

For these long-duration EMD portfolios, bottom-up credit research is critical for both day-one selection and ongoing credit monitoring. A low-turnover approach is often adopted to minimize accounting volatility, especially for insurers that treat EMD portfolios as Available-For-Sale (AFS) under FASB or Fair Value through Other Comprehensive Income (FVOCI) under IFRS9.

Portfolios are usually hedged via currency derivatives such as cross-currency swaps to the currency of the insurer’s liabilities. Where cross-currency swaps are used for hedging, the EM bonds are typically not accepted as eligible collateral so a buffer of other assets (e.g., sovereign bonds or DM credit) is needed as a derivative collateral buffer. Other structures, such as SPIRE notes, can be used where insurers need EMD to be self-collateralized.”1

2. Non-life insurer matching portfolio

In the cases of non-life insurers, liabilities are generally shorter duration (around 2-3 years or less) and less certain. In our view, EMD markets are fertile ground for building short-duration portfolios, with approximately 45% of the hard currency universe with a maturity of less than five years. This can skew toward corporates, and the natural turnovers (as short-duration portfolios run-off) are supportive of an active approach and rotation.

3. Return-seeking / surplus portfolios

These include the return-seeking / growth part of a participating fund (where the insurer and policyholder share the risk) and insurers’ surplus portfolio (i.e., assets are greater than liabilities).

More risk is typically taken here, with insurers both investing across the credit spectrum, including sub-IG, and sometimes allocating to unhedged local currency EMD exposures—although historically local currencies have displayed added volatility but little or no additional returns. Alongside high currency risk capital charges under different insurance capital regimes globally, this can discourage investment where the insurer owns the risk.

Figure 1: Illustrative currency risk capital charge

| Solvency 2 (EU) | Solvency UK | Singapore RBC2 | Bermuda BSCR | ICS (Japanese Yen Base Currency)* | ICS (Korean Won Base Currency)* | |

|---|---|---|---|---|---|---|

| EM currency risk capital charge | 25% | 25% | 12% | 25% | 33% | 25% |

Source: L&G. Data as of July 2025. RBC = Risk Based Capital. BSCR = Bermuda Solvency Capital Requirement. ICS = International Association of Insurance Supervisors Insurance Capital Standard Level 1 and Level 2 texts December 2024. *Capital charge calculated based on JPM GBI EM Local ccy govt bond index.

What actions should insurers consider? We see three key actions:

1. Focus on avoiding the losers

We believe there is an information asymmetry within EMs and there are quite a few under-researched issuers, market conditions we believe favor an active style. As the universe keeps on growing, new issuers have been able to access debt markets for financing, which can create more opportunities.

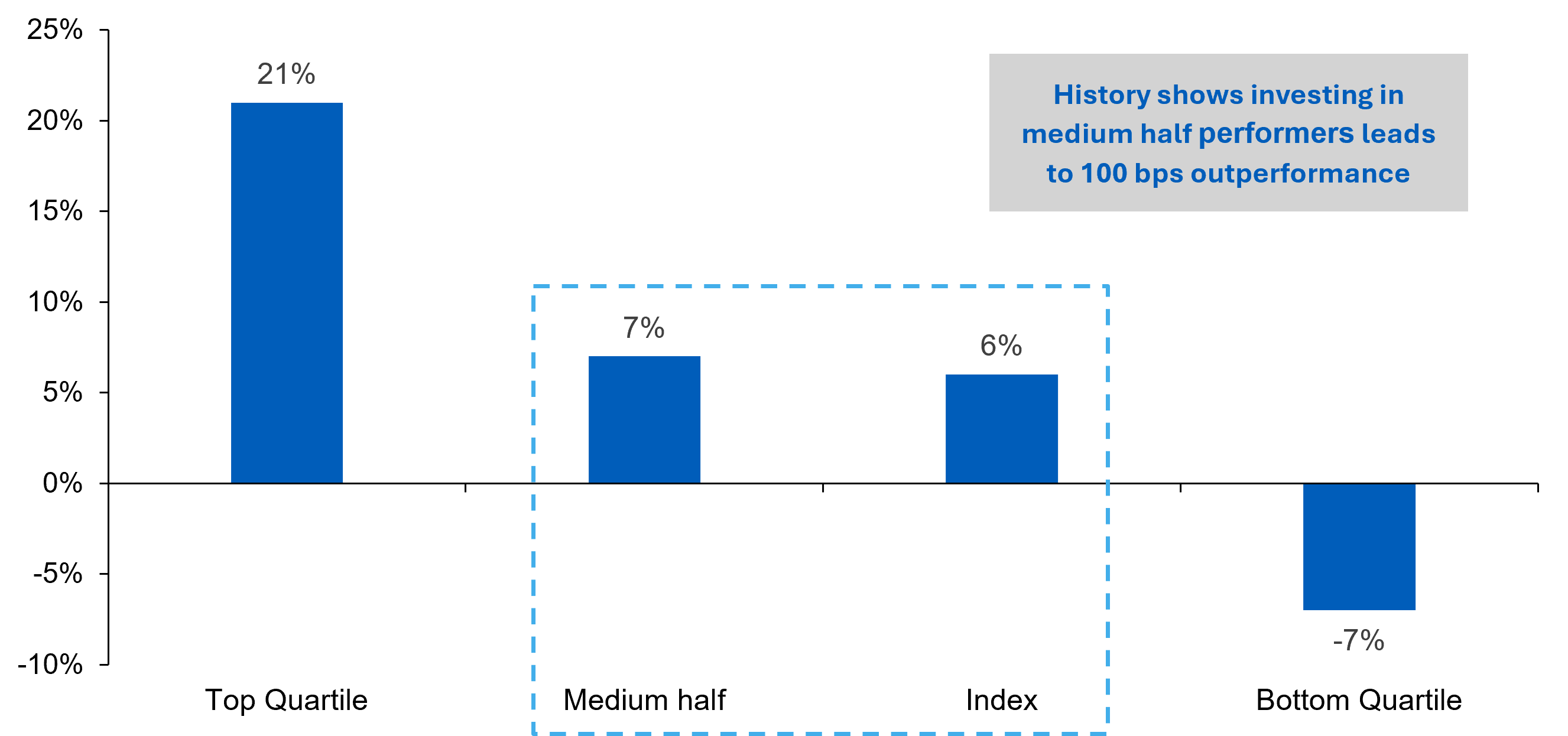

Historical analysis shows that active managers can seek to outperform the index by just investing in median countries and avoiding the tails, as we can see in Figure 2. Of course, identifying winners can potentially enhance returns; however, we believe it is more important to avoid losers than to identify winners.

Figure 2: Historical average annual returns in EMBI GD countries: Top-quartile, medium-half, index and bottom-quartile performers

Source: JP Morgan. Data as of May 14, 2025. Data cover the period January 2003 to October 2024. Past performance is not a guide to the future. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, and the investor may get back less than the original amount invested.

2. Consider an EM private debt allocation

Historically, few insurers have ventured into EM private debt markets due to their specific risk appetites and prudent person considerations. This is starting to change as insurance balance sheet-friendly investment opportunities emerge.

3. View your portfolio through a new diversification lens

EMD is often harnessed for the diversification benefits it can offer portfolios. It’s still too early to know for certain what the new contours of international trade will be in the wake of the Trump administration’s tariff policies, but it is conceivable that the world economy will segregate into distinct trading blocs. This could then become another diversification lens in which to manage your portfolio—but only time will tell.

1. Single Platform Investment Repackaging Entity.

Disclosures

Views and opinions expressed herein are as of the date published and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Unless otherwise stated, references herein to "L&G", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser) , Legal & General Investment Management Japan KK (licensed by the FAS in Japan), and LGIM Singapore Pte. Ltd. (licensed by the MAS in Singapore).