Combatting Complexity with Enhanced Beta

Two well-known trends have dominated asset allocation for the past two decades: the proliferation of private alternatives and the rising prominence of passive investing. The allure of each is obvious. The former offers attractive potential excess returns, while the latter saves cost in other highly efficient markets. However, these trends colluded, and the current market environment has revealed a growing number of challenges for managing portfolios with increasingly large allocations to both styles of investments. Fortunately, these challenges are met with opportunities. Below we offer observations from the market and our client conversations. Additionally, we highlight two simple approaches to alleviate some of the pressure and complexity vexing allocators currently.

Passive neglect

An astounding 73% of institutional investors surveyed by WTW’s Thinking Ahead Institute cited “managing complexity” as their top concern.1 This is completely understandable. The governance burden and due diligence costs for private alternatives are very high. There are myriad private equity styles and vintages and hedge fund strategies, and allocations to any single manager or vintage tend to be smaller with the natural result being a high number of investments required to meet policy targets.

All the attention required by alternatives has left many clients with a liquidity conundrum. In some cases, clients may have ample liquidity but lack the resources to manage it as efficiently as possible, creating a restlessness to squeeze more value out of their assets at a time when all institutions are being pressured to generate ever-higher returns. In other cases, we hear clients whose portfolios are squeezed by the rising proportion of private assets and are challenged to manage overall risk and liquidity.

Interestingly, though, the rise of passive investing has healthful side effects for beta markets. The commoditization of index fund management and the rise in systematic investing may leave significant value that can be potentially harvested by investors with a thoughtful approach to implementing passive, public market exposures.

Low risk alpha generation for passive investors

Indices include micro-inefficiencies due to adherence to transparent and published methodologies. The largest index fund managers are only incentivized to match the indices with the absolute minimal tracking error. On the other hand, those index inefficiencies can be exploited in a risk-controlled way to deliver true “market” returns and not just “index” returns.

L&G Asset Management, America applies a highly diversified, research driven approach to both tactical and strategic active positions for equity index exposures. Stock-specific risk is controlled through position size and diversification, while maintaining country and sector neutrality is designed to ensure tracking error remains very low and similar to traditional index portfolios. Those active positions fall into four categories:

| Event driven | Rebalance prediction |

|---|---|

| Risk inefficiencies | Synthetic asymmetries |

An approach like this benchmarked to MSCI World would aim to outperform the index by 25 basis points p.a., net of fees, with 50 basis points of tracking error volatility. Active return and risk targets can vary by index (due to each one’s construction methodologies), associated opportunity set and client preferences and constraints.

Dynamic beta implementation for funding opportunities

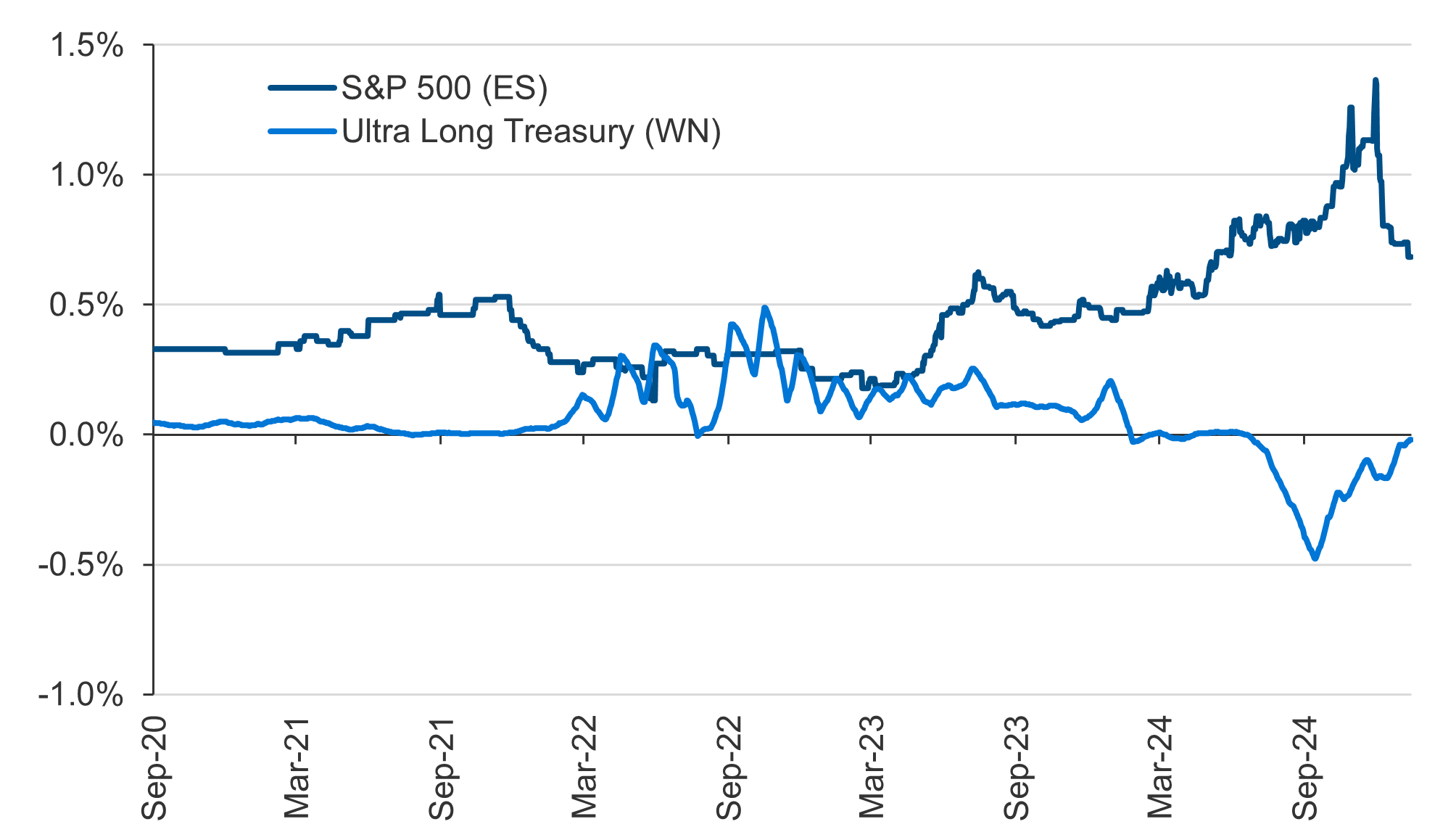

The rise of systematic investing coincided with a shifting regulatory landscape, such that the relative supply and demand for index derivatives can significantly move the incremental costs of those exposures (i.e., versus short-term funding rates as in Figure 1).

Figure 1: Futures implied funding spreads

Source: L&G – Asset Management, America. Data as of February 28, 2025.

Large differences in the relative cost of common passive exposures—like S&P 500 and US Treasuries—are an opportunity to add value to an investor’s portfolio. By partnering with a manager who can dynamically shift allocations to common passive exposures, the investor can simultaneously (1) achieve their target risk exposures, (2) maintain a high level of liquidity and (3) receive a net funding benefit as outperformance against the passive exposures.

For example, in the current market, an investor would allocate the majority of their available passive capital to an S&P 500 fund and then overlay that exposure to their desired mix of equity and Treasuries (i.e., sell equity and buy Treasuries synthetically). The result is a highly liquid portfolio of passive investments that achieves the appropriate asset allocation targets and will outperform their benchmarks by receiving a net financing payment.

Bringing it all together – a dynamic beta partnership

Enhanced indexing offers potential outperformance through low risk methods that traditional passive managers forego. Selectively utilizing derivative exposures for passive investments can also at times add value in markets where the investor receives a material funding spread. However, the magnitude of the opportunities, particularly in derivatives funding markets, will vary across assets and time. Similarly, to provide liquidity and rebalance a portfolio, allocators’ required allocations to passive investments will vary over time and in size.

Our firm is a sophisticated beta manager, offering both enhanced indexing and derivative overlays. As a thoughtful partner, we can help investors maximize the efficiency of their portfolios and take on some of the complexity management that is proving so challenging for allocators. An illustrative partnership would involve an allocated pool of physical capital, a set of permissible fund and derivative investments, and a thorough understanding of the portfolio’s allocation targets and benchmarks. We would implement beta exposures much like a standard policy overlay but with the extra attention on optimizing exposures across physical and passive investments to try to achieve a performance and funding benefit versus traditional passive allocations.

Outsourcing the complexity of efficient beta management captures value where other investors are remiss and relaxes resource constraints, enabling a sharper focus on all other dimensions of institutional portfolio management.

1. WTW, Thinking Ahead Institute. https://www.thinkingaheadinstitute.org/content/uploads/2024/07/FF-TAI_AOPS24_Summary-Report.pdf

Disclosures

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

In certain strategies, L&G – Asset Management, America might utilize derivative securities which inherently include a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

Reference to an index does not imply that an L&G – Asset Management, America portfolio will achieve returns, volatility or other results similar to the index. You cannot invest directly in an index, therefore, the composition of a benchmark index may not reflect the manner in which an L&G – Asset Management, America portfolio is constructed in relation to expected or achieved returns, investment holdings, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change over time.

No representation or warranty is made to the reasonableness of the assumptions made or that all assumptions used to construct the performance provided have been stated or fully considered.

These assumptions are theoretical and intended to provide a conceptual framework for understanding how certain investment strategies or models might operate under idealized conditions. These assumptions do not reflect actual market conditions or specific investor circumstances. Hypothetical scenarios may simplify complex market dynamics and investor behaviors. They may not fully capture the impact of variables such as market volatility, liquidity constraints, or transaction costs. The assumptions used may have inherent limitations and may not accurately represent future market conditions or investor experiences. They are designed for illustrative purposes only and should not be interpreted as predictive of actual performance or outcomes.

There is no guarantee that actual results will match the outcomes suggested by these hypothetical assumptions. Real-world investing involves risks and uncertainties that may differ from the assumptions made in these scenarios. Investors should carefully consider their own financial situation, risk tolerance, and investment goals before making decisions based on hypothetical assumptions. It is recommended to consult with a financial advisor to understand how these assumptions might apply to actual investment scenarios.

Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, L&G – Asset Management, America has not independently verified such information, nor does it assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. L&G – Asset Management, America’s opinions and estimates constitute L&G – Asset Management, America’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only.

Portfolio credit quality is calculated using a market value weighted average, based on the conservative average of Moody’s, S&P, and Fitch ratings expressed in Moody’s nomenclature. If all three ratings agencies rate the security, it is the middle of the three, if two, the lower of two, and if one, that becomes the rating.