Borrowing Brilliance – Advantages in Fixed Income Portable Alpha

We have seen a remarkable resurrection of interest in portable alpha recently. Evidence of this resurgence ranges from client inquiries to industry papers and articles to conference panels and side bars. Portable alpha is a long-standing construct that allows investors to access potential enhanced performance through a range of markets and strategies and transfer those returns to their portfolio’s strategic benchmark by using a derivative overlay. In a classic example, alpha is sourced from hedge funds and overlaid with US large cap equity beta. This has the potential to help investors beat benchmarks in markets that are otherwise highly efficient and difficult to outperform.

As many hedge fund styles struggled to meet performance expectations in the post-global financial crisis period, portable alpha fell out of favor. Since then, though, we have experienced a surge in availability and liquidity of index derivatives and also witnessed increasingly difficult environments for traditional active management against those indices. So, while we can only speculate on portable alpha’s resurgent popularity, we are very supportive, as there are myriad ways to source potential enhanced return to portfolios while effectively managing tracking error against strategic benchmarks. Below we illuminate some important—and often overlooked—considerations for deploying portable alpha strategies. We also highlight our view that portable alpha is best expressed through fixed income markets, which we believe is a more efficient and effective way to capture the underlying strategy’s active return.

Construction considerations

There are a few key variables to consider for optimally pairing an underlying active strategy with a target portfolio beta:

- The volatilities of the active strategy and target beta, as well as their correlation to each other (i.e., their covariance).

- Liquidity and collateral

- Derivatives funding costs

- Performance expectations and hurdles

The more volatile either component of a portable alpha implementation, the more difficult and costly it will be to rebalance the strategy and manage liquidity. A more volatile beta overlay requires more capital to be held in reserve for collateral, which proportionately reduces the capital available for the alpha source. If the active strategy is relatively illiquid or expensive to trade, additional collateral or liquidity might need to be sourced from other parts of the portfolio. Sourcing liquidity from other allocations may also be necessary if the active strategy is highly correlated with the beta to avoid compelled sales at depressed valuations of the former to fund losses in the latter.

Concerns about the volatilities of the components may sometimes be mitigated depending on eligible collateral for the overlay. In some cases, components of the strategy may also serve as collateral for the overlay. For example, any cash or treasuries held directly as part of the alpha strategy can help collateralize the overlay. Or, if the target beta includes exposure to cash or treasuries, those exposures can be carved out of the overlay and held directly. This approach may enhance the liquidity of the overall strategy, making it easier to manage during periods of higher volatility or correlation between the components.

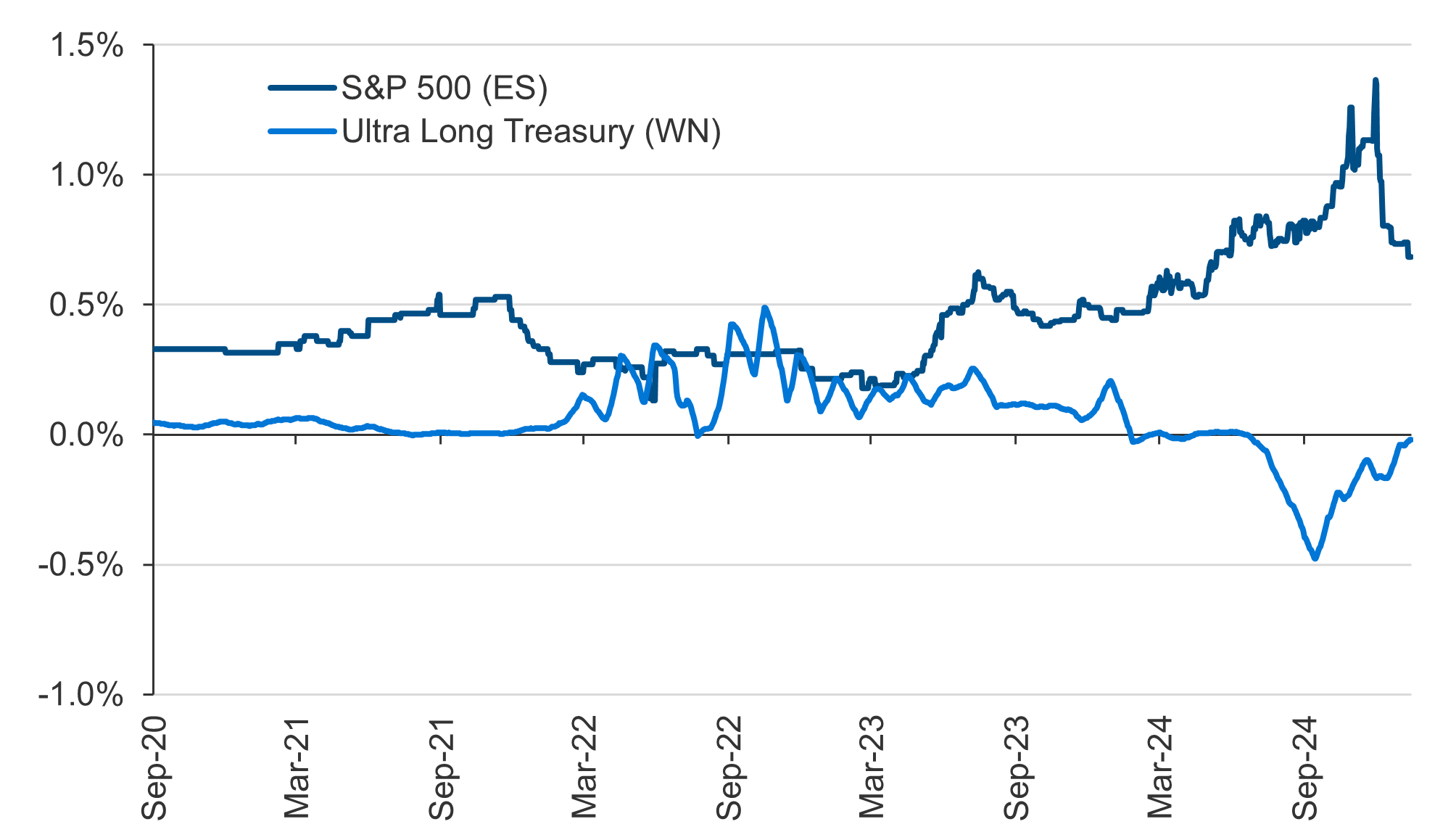

Derivatives funding costs are trickier, as they include two components: an overnight reference rate (determined by short-term rates) and a funding spread (driven by supply and demand for levered exposure to the target beta). The reference rate will be offset by the risk-free return component of the active strategy and the funding spread will be offset by the expected risk premium or alpha of the active strategy, each in proportion to how much is invested in the active strategy versus capital held as collateral. Critically, funding spreads exhibit their own volatility and trends across markets and time (see Figure 1). Portable alpha may therefore be most efficient with flexible beta for investors who partner with a dynamic overlay manager. That manager could help switch the target beta across a set of strategic exposures, both synthetic and physical, to optimize performance, liquidity, and cost.

Figure 1: Futures implied funding spreads

Source: L&G – Asset Management, America. Data as of February 28, 2025.

After all the aforementioned considerations, investors are left with a reasonable idea of the potential outperformance of the target beta based on their return expectations. The passthrough of the active strategy’s returns is a function of the volatility and cost of the target beta. Higher volatility and higher cost increase the performance hurdle of the active strategy. As we expect return and risk to be intrinsically linked, relying on a higher volatility active strategy has the potential to create a vicious volatility cycle.

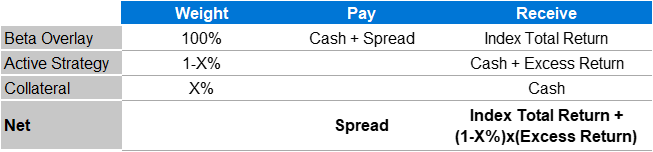

Figure 2: Net performance expectations illustration

Source: L&G – Asset Management, America. For illustrative purposes only.

Current opportunities in portable alpha

We believe that the most compelling expression of portable alpha currently is through fixed income markets. The lower volatility of most broad fixed income indices means that more capital can be invested into the active underlying strategy, or, in some cases, the collateral can also be part of the target beta. Additionally, funding spreads on fixed income derivatives tend to be lower than equity derivatives on average. This is especially true now with equity costs at historically rich levels.

Further, we like pairing fixed income beta with our Short Duration Opportunistic Fixed Income (SDOFI) strategy. The fund leverages expertise across fixed income teams with the goal of generating consistent and asymmetric returns in all market environments. The dynamic asset allocation process captures our best ideas across US Investment Grade Credit, US High Yield Credit, US Securitized, and Emerging Market Debt. It is managed to be duration-neutral, isolating alpha from carry and roll-down. This approach has the potential to provide a much greater breadth for generating excess returns, possibly offering better diversification than the traditional US Aggregate credit universe. It is also a lower volatility and higher liquidity strategy, making it an attractive and practical fit for a portable alpha construct.

The result is a portable alpha strategy that remains liquid and relatively low risk even through volatile periods. This may be an ideal approach for adding value to an investor’s overall portfolio.

Conclusion

L&G – Asset Management, America is uniquely situated to be a partner on portable alpha because we offer an active strategy with returns anticipated to be in line with expectations and lower volatility, bring deep expertise in derivatives, and have a comprehensive understanding of managing risks around allocators’ policy benchmarks. While we are generally supportive of portable alpha, clearly not all implementations are created equal. Partnering with a portable alpha manager who intimately understands the trade-offs inherent in the approach may afford distinct advantages for retaining as much outperformance as possible for the overall portfolio.

Disclosures

L&G – Asset Management, America, the contracting entity for this mandate, is an affiliate of Legal & General Investment Management Ltd., the global investment management arm of Legal & General Group, a FTSE 100 company. Investment management services will be performed by L&G – Asset Management, America directly, and certain portfolio management and other responsibilities may be delegated to an affiliate.

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

In certain strategies, L&G – Asset Management, America might utilize derivative securities which inherently include a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

Reference to an index does not imply that an L&G – Asset Management, America portfolio will achieve returns, volatility or other results similar to the index. You cannot invest directly in an index, therefore, the composition of a benchmark index may not reflect the manner in which an L&G – Asset Management, America portfolio is constructed in relation to expected or achieved returns, investment holdings, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change over time.

No representation or warranty is made to the reasonableness of the assumptions made or that all assumptions used to construct the performance provided have been stated or fully considered.

These assumptions are theoretical and intended to provide a conceptual framework for understanding how certain investment strategies or models might operate under idealized conditions. These assumptions do not reflect actual market conditions or specific investor circumstances. Hypothetical scenarios may simplify complex market dynamics and investor behaviors. They may not fully capture the impact of variables such as market volatility, liquidity constraints, or transaction costs. The assumptions used may have inherent limitations and may not accurately represent future market conditions or investor experiences. They are designed for illustrative purposes only and should not be interpreted as predictive of actual performance or outcomes.

There is no guarantee that actual results will match the outcomes suggested by these hypothetical assumptions. Real-world investing involves risks and uncertainties that may differ from the assumptions made in these scenarios. Investors should carefully consider their own financial situation, risk tolerance, and investment goals before making decisions based on hypothetical assumptions. It is recommended to consult with a financial advisor to understand how these assumptions might apply to actual investment scenarios.

Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, L&G – Asset Management, America has not independently verified such information, nor does it assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. L&G – Asset Management, America’s opinions and estimates constitute L&G – Asset Management, America’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only.

Portfolio credit quality is calculated using a market value weighted average, based on the conservative average of Moody’s, S&P, and Fitch ratings expressed in Moody’s nomenclature. If all three ratings agencies rate the security, it is the middle of the three, if two, the lower of two, and if one, that becomes the rating.

Unless otherwise stated, references herein to "L&G", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser) , Legal & General Investment Management Japan KK (licensed by the FAS in Japan), and LGIM Singapore Pte. Ltd. (licensed by the MAS in Singapore).