Why Private Credit Can Continue to Thrive

Private credit—loans made by non-bank lenders outside the public markets—has exploded in size over the past decade. Global private credit assets swelled to roughly $3 trillion in the second quarter of 2025. This rapid growth has led to criticism around the sustainability of the asset class. The fear is this growth has been accompanied by weaker underwriting—covenant-lite loans, high leverage and optimistic valuations are frequently cited along with press headlines warning that the sub-investment grade (sub-IG) market is entering bubble territory. However, we believe these concerns are overblown.

Delineating between two distinct universes

Private credit’s rise can be viewed as a structural shift: After the 2008 crisis, banks pulled back from lending to many businesses (due to regulation and capital rules), and private funds filled the void. Thus, much of the private credit AUM growth is simply the disintermediation of banks, not a speculative bubble on top of existing credit. Federal Reserve data point out that overall private-sector corporate indebtedness hasn’t spiked in the last decade. Companies are borrowing, but not dramatically more than before; they’re just borrowing more from private sources.

"Private credit," however, is not monolithic. It spans a spectrum from high-quality corporate loans (IG) to risky mezzanine debt (sub-IG), with IG and sub-IG private credit segments each having distinct characteristics.

- IG private credit consists of private loans made to highly rated borrowers across widely diverse sectors and maturities. These are fixed rate products that carry a rating from a third-party agency—just like their public equivalents. One example: private placements.

- Sub-IG private credit includes loans to lower-rated, often middle-market companies (essentially an alternative to public leveraged loans or high-yield bonds). It encompasses direct lending, mezzanine financing and other types of higher-yielding private debt. These are floating rate products that are governed by custom / proprietary rating policies.

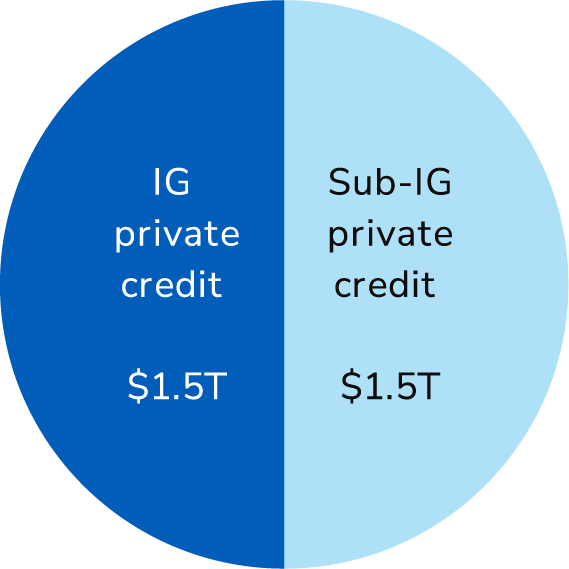

Each category is sizeable—on the order of ~$1.5 trillion each in outstanding loans—but the segments have varying investor bases and risk profiles.

Figure 1: Both segments of the private credit market are sizeable

Source: L&G – Asset Management, America.

Assessing downside risks

IG private credit

Even if we suppose the bearish case that the sub-IG side of private credit enters bubble territory, this does not automatically mean the entire private credit market would collapse or spread turmoil broadly. Several factors compartmentalize risks, especially between the two segments of the private credit market:

- Different borrowers, different risks: The IG side is lending to high-quality companies, projects and financing facilities with strong balance sheets and predictable cashflows. The sub-IG side is funding highly leveraged companies often backed by private equity. Trouble in one cohort doesn’t necessarily translate to the other. For instance, a wave of defaults in speculative B-rated retailers wouldn’t imply anything about the ability of an AA-rated infrastructure project to pay its private placement coupons.

- Different lenders, similar appetite: IG private credit investors (for example, insurers and pensions) typically hold these loans to maturity, using them to match long-term liabilities. They are not mark-to-market traders, but neither are sub-IG investors. These investors do not tend to lean on their private credit allocations for liquidity.

- Limited interconnectedness: One hallmark of the 2008 global financial crisis was interconnectivity. Banks and markets were linked by levered subprime mortgages. Private credit, by contrast, is more siloed. Loans are not broadly traded or held by leveraged intermediaries who lend to each other. Instead, they sit on the books of funds and insurance accounts that generally match them with long-term capital.

- Structural protections in IG loans: IG private loans typically have tight covenants and security packages. This means if a borrower’s financial performance slips, IG lenders can often step in early—often well before any payment default—to renegotiate terms, obtain additional collateral or even demand repayment.

Sub-IG private credit

The bearish case is not our base case. We do not expect that the sub-IG private credit segment will collapse given the following factors:

- Private equity sponsor support: A large portion of direct lending is sponsor-driven (for example, loans made to private equity owned companies). Sponsors are not passive bystanders. They typically have 30-50% equity invested in these companies.

- Active management: Private credit managers often tout their ability to be “partner lenders.” They stay close to the borrower with frequent reporting and board observation rights in some cases.

- Diversification and dry powder: The private credit universe itself is highly diversified—by sector, geography and borrower—unlike the loans that characterized the housing bubble. Additionally, many private credit funds still have undrawn capital commitments. In a downturn, that dry powder can be used to support portfolio companies or selectively buy distressed loans (providing a floor to valuations).

Conditions for private credit to thrive

Looking forward, we believe both IG and sub-IG segments have the opportunity to thrive under certain basic conditions. IG lenders must remain committed to third-party rating agency oversight to maintain rating standards. Sub-IG lenders, on the other hand, must stay focused on robust economic opportunities at measured risk levels and avoid non-economic performance objectives. Over the past twenty years, non-bank lenders have continued to offer unique and customized financing solutions to IG and sub-IG segments, as healthy capital markets require lenders in every rating category and across investment horizons.

Disclosures

Legal & General Investment Management America, Inc. (d/b/a L&G – Asset Management, America) (“LGIMA”, “LGIM America”) is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”). LGIMA provides investment advisory services to U.S. clients. L&G’s asset management division more broadly—and the non-LGIMA affiliates that comprise it—are not registered as investment advisers with the SEC and do not independently provide investment advice to U.S. clients. Registration with the SEC does not imply any level of skill or training.

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the “Offering Materials”) that will be furnished to prospective investors. Before making an investment decision, investors are advised to carefully review the Offering Materials, and to consult with their tax, financial and legal advisors. L&G – Asset Management, America does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects L&G – Asset Management, America’s views as of the date hereof and may be changed in response to L&G – Asset Management, America’s perception of changing market conditions, or otherwise, without further notice to you. Accordingly, the information herein should not be relied on in making any investment decision, as an investment always carries with it the risk of loss and the vulnerability to changing economic, market or political conditions, including but not limited to changes in interest rates, issuer, credit and inflation risk, foreign exchange rates, securities prices, market indexes, operational or financial conditions of companies or other factors. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance or that L&G – Asset Management, America’s investment or risk management process will be successful.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

Unless otherwise stated, references herein to "L&G", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser) , Legal & General Investment Management Japan KK (licensed by the FAS in Japan), and LGIM Singapore Pte. Ltd. (licensed by the MAS in Singapore).

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.