CIO Insight: The Economic Risk if AI Delivers

While AI- skepticism runs high, there’s been a lot less investor focus on the implications should AI deliver. Historical parallels suggest a modest productivity boost translating into 30-50 basis points of gross domestic product (GDP) uplift for a decade, before the economy reverts to trend. But AI’s potentially universal application and “agentic” ability to replicate human output hint at a far bigger impact that poses a potential risk scenario for the economy as AI delivers.

We call this risk “the fatter K scenario.” A "K-shaped recovery" describes an economic rebound where different parts of the economy recover at different rates, creating a split that resembles the letter "K" on a graph.

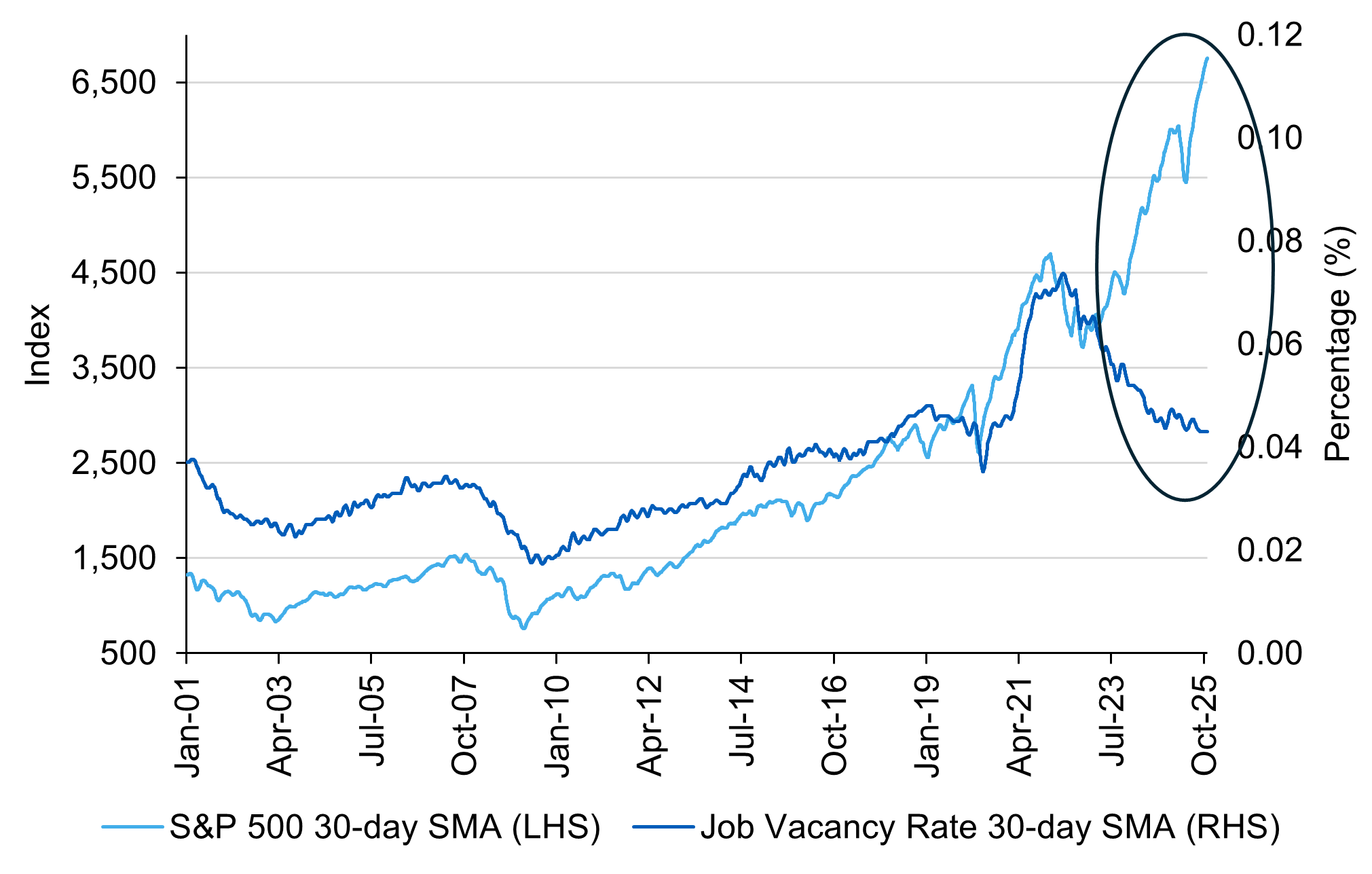

We’re currently seeing a K-shaped disconnect between the AI-fueled stock boom and the labor market, as Figure 1 below shows. One potential risk scenario for the economy is that AI increasingly weighs on white-collar jobs even as productivity rises. The labor market already looks fragile; companies have paused hiring given tariff uncertainty while anticipating AI productivity gains to come. A move to shed labor outright could fatten the bottom branch of the K, squeezing median and youth consumers.

Typically, such a scenario would impact growth and might lead to a recession, but if AI is delivering productivity gains and driving an investment capex boom, then GDP might remain near trend even as the unemployment rate rises—a very unusual scenario.

How markets react to the “fatter K” scenario is tricky to predict. If median-consumer weakness drives disinflation and the unemployment rate rises while growth stays near trend, the Federal Reserve could cut aggressively. Lower rates may not save jobs but could be risk-positive for markets.

While we are certainly on the lookout for AI disruption to the labor market, our base case is that 2026 growth ends up in the 1.5–2.0% range, with AI-driven capex and productivity gains continuing to drive economic momentum. Payroll gains are likely to stay weak and the unemployment rate below 4.5%, as companies refrain from shedding labor for now in line with historical productivity booms where labor shedding comes later.

Figure 1: There is an unprecedented gap between the AI-fueled stock boom and US job openings

Source: Bloomberg, L&G – Asset Management, America. Data as of November 13, 2025. SMA refers to smoothed moving average.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.