The Case for Securitized in End-Game Strategies

Pension investors seeking ways to enhance yield, improve diversification and maintain liquidity in their end-game strategies may be overlooking a compelling asset class: US securitized. With a yield pick-up, low correlation to other fixed income and ample liquidity, securitized credit presents an attractive opportunity for portfolio construction.

Corporate defined benefit plans continue to see funded status improvements, and client conversations increasingly center on how to optimize their end-game portfolio given rising allocations to fixed income. Incorporating securitized assets in end-state portfolios can unlock significant benefits while supporting the primary objective of funded status preservation. By allocating a portion of the fixed income portfolio to high-quality securitized assets, plan sponsors may be able to optimize returns without sacrificing their hedging objectives.

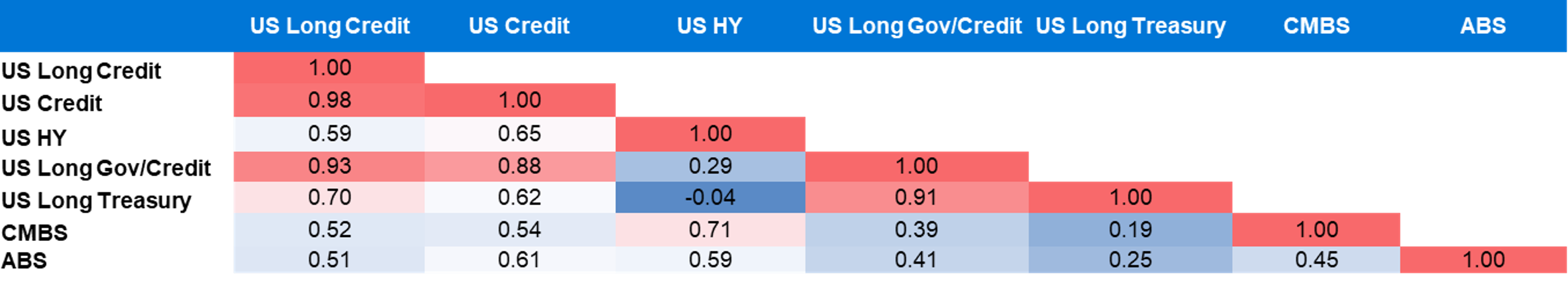

Securitized assets can offer an attractive spread pick-up over traditional public market bonds for the same or even higher credit quality. As depicted below, US securitized has offered an attractive yield for its credit rating, making it a potentially suitable option for investors seeking an opportunity to enhance returns.

Figure 1: Yield per credit rating of major fixed income benchmarks

Source: Data compiled from standard Bloomberg indices for all benchmarks. Data as of December 31, 2024.

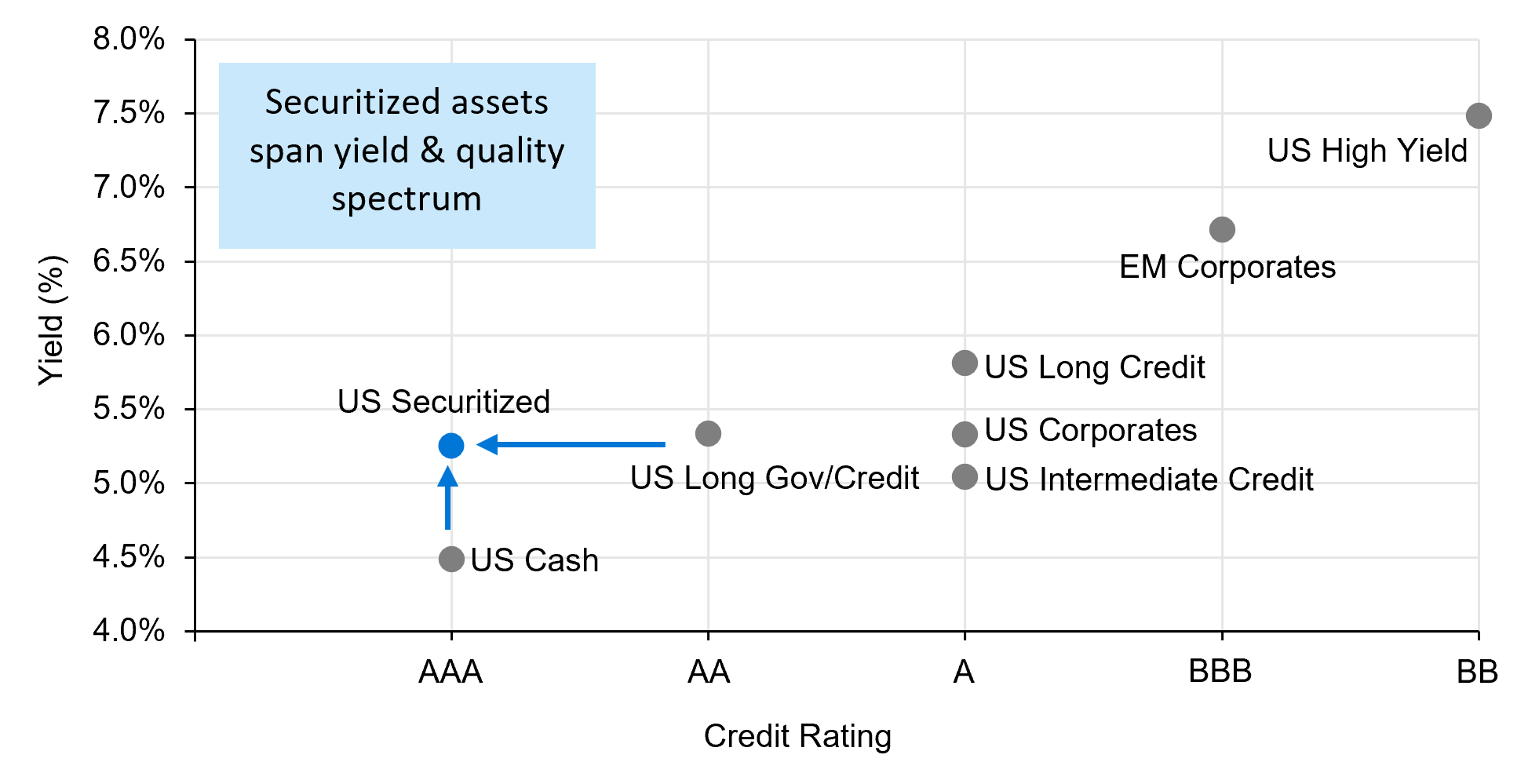

The securitized market is vast, offering a wide array of products and exposures. While Agency mortgage-backed securities (MBS) is the largest sector within the securitized asset class, we tend to favor [non-agency] commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS) for our LDI portfolios. These sub-sectors offer characteristics that are in demand for pension plans in the later stages of their de-risking journey, namely enhanced yield, high quality, and diversification. As depicted in Figure 2, these sub-sectors can deliver an attractive risk-adjusted return when compared to the broader fixed income universe.

Figure 2: Risk-adjusted returns across fixed income

Source: Data compiled from standard Bloomberg indices for all benchmarks. Data range between March 31, 1997- December 31, 2024.

Understanding the basics of CMBS and ABS

At their core, CMBS and ABS are pools of loans backed by tangible assets. Unlike corporate bonds, which are generally backed by the free cash flow of a company, securitized assets are collateralized by income producing assets:

- CMBS: Loans secured by income-producing commercial real estate, such as office/hotels/retail/industrial/multifamily properties.

- ABS: Loans backed by a diverse range of asset types and can be separated into flow (autos/cards/equipment) and esoteric/commercial ABS (timeshare/triple net leased/datacenters/franchise/rail and container leasing/tax liens) to name a few.

Securitization pools these loans and issues tranches with varying risk levels, supported by structural protections such as subordination and over collateralization. One key distinction between securitized products and corporate bonds lies in the ability to select risk exposure. In corporate credit, bondholders rely on the company’s ability to generate cash flow to repay debt. In contrast, investors in securitizations can use the benefit of tranching to select exposures that benefit mandates from a ratings and expected return perspective. In addition, investors in securitizations often have direct claims on the underlying assets, which offer additional protection in the event of a sponsor bankruptcy. These differences help explain the diversification benefits the asset class offers.

Diversification benefits

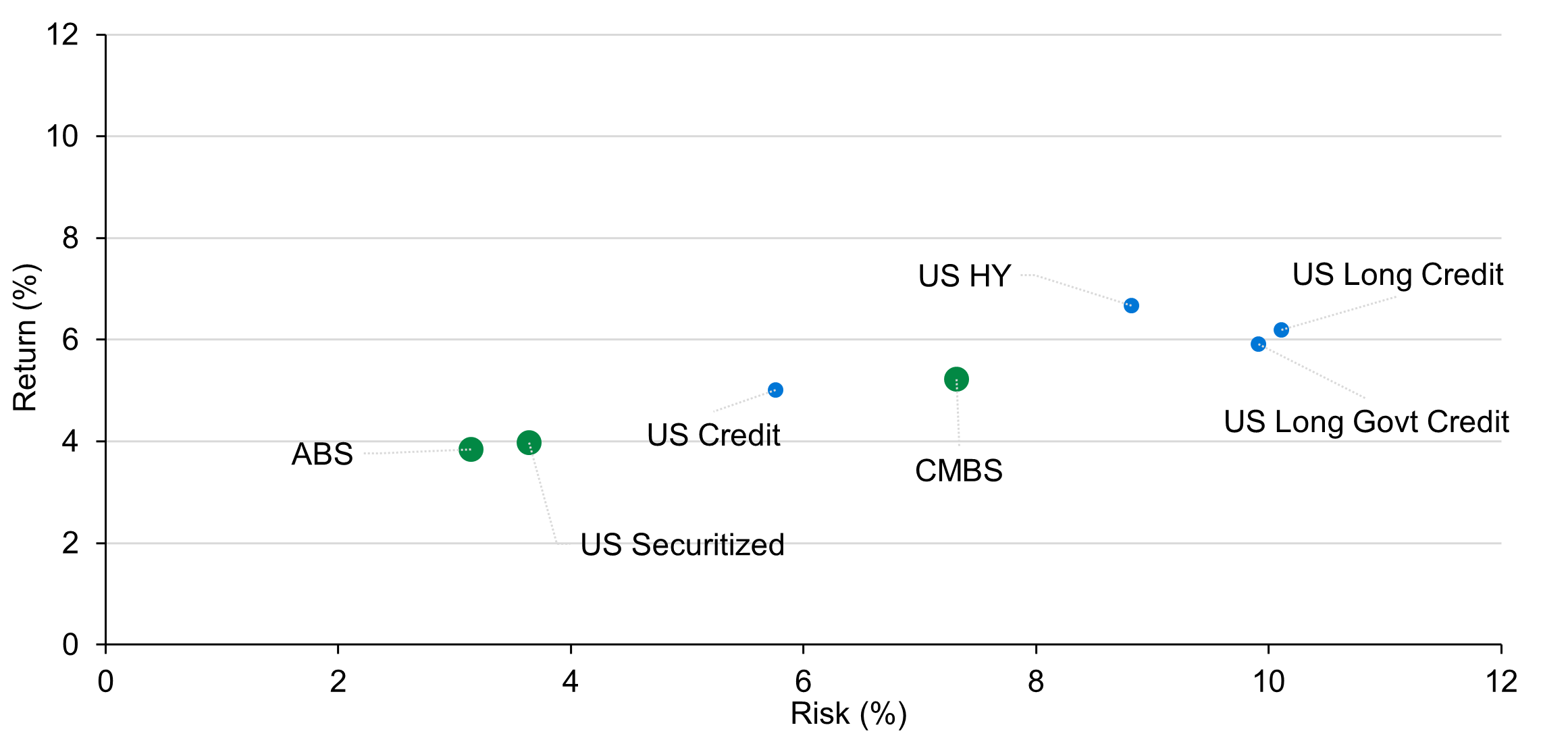

Another strong argument for incorporating securitized assets into an end-game portfolio is the low correlation to other fixed income. Liability driven investing (LDI) and end-game portfolios are primarily built with investment grade corporate bonds. While this will likely always be the case, we believe allocating a small portion of the portfolio to securitized assets can lead to better funded status outcomes. As Figure 3 illustrates, [non-agency] CMBS and ABS exhibit lower correlations with traditional fixed income asset classes.

Figure 3: Correlation matrix (March 31, 2008 – December 31, 2024)

Source: Data compiled from standard Bloomberg indices for all benchmarks. Data as of December 31, 2024.

By adding securitized credit to end-game portfolios, investors have the opportunity to reduce overall portfolio volatility and enhance resilience during periods of market stress. Additionally, the yield pick-up provides benefits in an asset-liability context, ultimately improving funded status outcomes. Lastly, the high-quality nature of the asset classes we participate in/focus on do not jeopardize the overarching goal for many plan sponsors: funded status preservation.

Disclosures

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

The material in this presentation regarding Legal & General Investment Management America, Inc. (“LGIMA”) is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation, and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. LGIMA does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects LGIMA’s views as of the date hereof and may be changed in response to LGIMA’s perception of changing market conditions, or otherwise, without further notice to you.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.