Short Is Still Sweet: SDOFI Takes the Cake in Today’s Fixed Income Regime

In a world where US policy is fraught with uncertainty, why extend out the curve and expose yourself to more duration risk for marginally higher yield amidst a major growth scare? Instead, embrace the time-tested principle of keeping it short and sweet.

The pandemic has given rise to transformational changes, and the fixed income market has certainly not escaped its reach, and we now find ourselves in a much different regime than the one we grew accustomed to over the past decade. In the last three years the Fed increased rates at the fastest pace in 40 years, which has led to a challenging environment for fixed income returns.

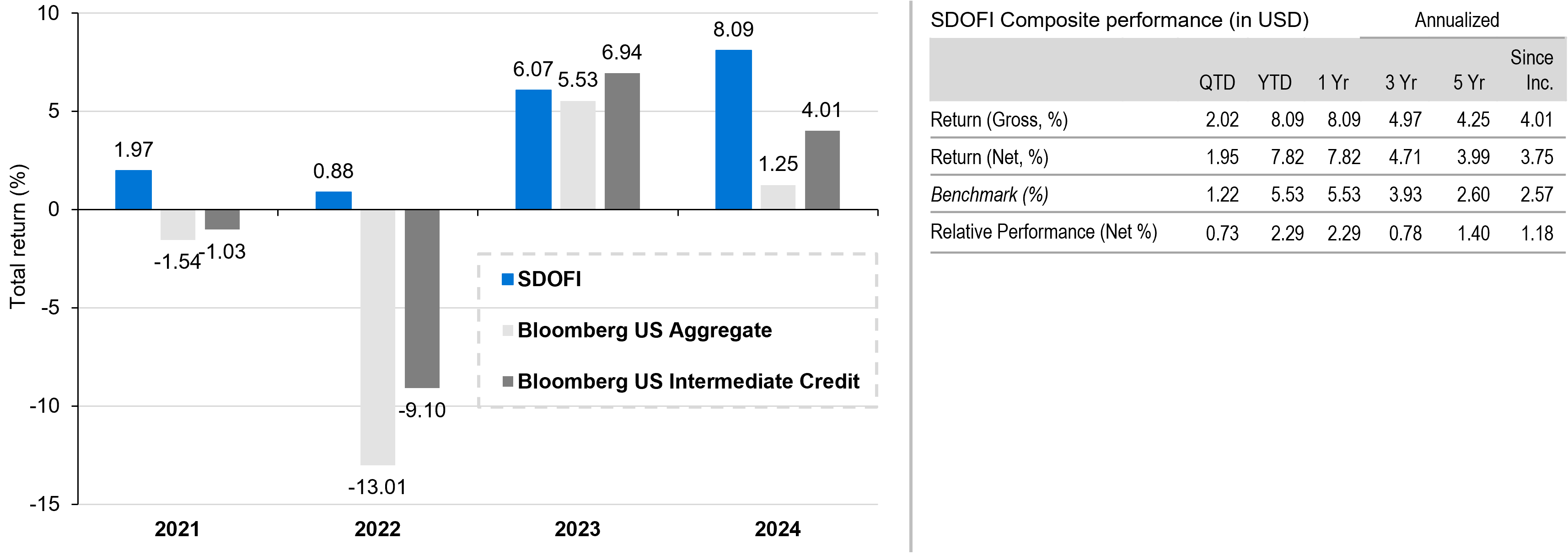

However, our Short Duration Opportunistic Fixed Income (SDOFI) strategy is designed to preserve capital and produce positive returns across multitude of environments, where it has been in line with expectations since 2009. This includes 2021 and 2022 where the fixed income market landscape was difficult to navigate. The structure of our strategy enabled us to find a way to preserve capital for investors despite the sharp move higher in rates.

Figure 1: Positive total returns in challenging environments1

The key ingredients

Our strategy is managed by an experienced team and benefits from an expanded toolkit, with the flexibility to invest in investment grade and high yield credit, securitized products and emerging markets - while always maintaining an investment grade rating overall. We also utilize credit derivatives like CDX and TRS to efficiently hedge credit risks when we expect deterioration in the outlook.

Finally, the rate duration of the strategy is maintained around the 0 bound, limiting exposures to rate moves.

The way it's best served

1. SDOFI as a complement to Bloomberg US Aggregate Bond Index (US Agg)

Despite having a duration pinned around 0, SDOFI currently yields more than the US Agg – 5.7% vs. 4.7% - while carrying a historical average correlation of 0.08.2

By allocating some of the existing fixed income pool to a strategy like SDOFI, investors can diversify away from some of the more dominant features of the US Agg:

Limited scope: The US Agg only tracks bonds that are of investment grade quality or better. This means it excludes certain segments of the bond market, such as high-yield bonds and emerging market debt, which come with increased risks of default/downgrade and heightened volatility, respectively, but can drive strong risk-adjusted returns.

Rate sensitivity: The index carries a duration of 6.1 years in a new, unpredictable interest rate environment.

Historical bias: The US Agg was founded in the 1970s, and some of its data dates to only 1986, a time when interest rates began to decline from all-time highs. Should the higher-for-longer rate environment persist, the index could lose the natural support of falling rates through time.

2. SDOFI as a cash enhancement

The well-known mantra “cash is trash” is no longer appropriate given today’s market backdrop. With elevated short-term rates and an inverted yield curve investors may benefit from a dynamic solution that exploits opportunities across the fixed income landscape while adding a modicum of increased risk.

Such a strategy can come with meaningful liquidity as well. This is evident in our experience through the Fall of 2022 where collateral calls intensified amidst rapidly rising rates. Our fund met 100% of same-day outflows, selling pro-rata across holdings. In this case, the portfolio saw only marginal increases in trading costs ultimately delivering 98-100% of fair value.

Amidst a sea of change the one principle that seemingly remains unscathed is “short is still sweet.”

1. Source: L&G – Asset Management, America and Bloomberg. ICE BofAML USD 3-Month Constant Maturity. Data as of December 31, 2024. Past performance is not indicative of future results. Inception date is January 31, 2007. Please note that the composite inception date is February 29, 2008. The "since inception" figure in the table above represents performance as of the last performance break noted in the following. The composite has a break in its performance track record for the month of March 2018 due to significant cashflows in underlying portfolios. Therefore, certain composite statistics are not available in accordance with GIPS Standards. Additional information is available upon request. Gross composite performance is presented before management fees, subscription charges by pooled funds, and extraordinary expenses but after trading costs, non-reclaimable foreign withholding taxes and pooled fund operating expenses. Net performance, which is further described in the attached GIPS Composite Report, is calculated by deducting the model fee from the gross composite return. The model fee is the maximum potential management fee charged to an account in the composite, although actual fees may vary. The model fee is 0.25% per annum since inception. Returns reflect the reinvestment of dividends and other income earnings. Investment advisory fees are described in Part 2A of Form ADV. All objectives and limits are for informational purposes, are forward looking statements that are inherently uncertain and are not guaranteed. Actual results may vary substantially.

2. Source: L&G – Asset Management, America and Bloomberg. Data as of December 31, 2024

Disclosures

Legal & General Investment Management America, Inc. (d/b/a L&G – Asset Management, America) (“L&G – Asset Management, America” or “L&G”) is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”). L&G – Asset Management, America provides investment advisory services to U.S. clients. L&G’s asset management division more broadly—and the non-L&G – Asset Management, America affiliates that comprise it—are not registered as investment advisers with the SEC and do not independently provide investment advice to U.S. clients. Registration with the SEC does not imply any level of skill or training.

L&G – Asset Management, America, the contracting entity for this mandate, is an affiliate of Legal & General Investment Management Ltd., the global investment management arm of Legal & General Group, a FTSE 100 company. Investment management services will be performed by L&G – Asset Management, America directly, and certain portfolio management and other responsibilities may be delegated to an affiliate.

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the “Offering Materials”) that will be furnished to prospective investors. Before making an investment decision, investors are advised to carefully review the Offering Materials, and to consult with their tax, financial and legal advisors. L&G – Asset Management, America does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects L&G – Asset Management, America’s views as of the date hereof and may be changed in response to L&G – Asset Management, America’s perception of changing market conditions, or otherwise, without further notice to you. Accordingly, the information herein should not be relied on in making any investment decision, as an investment always carries with it the risk of loss and the vulnerability to changing economic, market or political conditions, including but not limited to changes in interest rates, issuer, credit and inflation risk, foreign exchange rates, securities prices, market indexes, operational or financial conditions of companies or other factors. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance or that L&G – Asset Management, America’s investment or risk management process will be successful.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

In certain strategies, L&G – Asset Management, America might utilize derivative securities which inherently include a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

Reference to an index does not imply that an L&G – Asset Management, America portfolio will achieve returns, volatility or other results similar to the index. You cannot invest directly in an index, therefore, the composition of a benchmark index may not reflect the manner in which an L&G – Asset Management, America portfolio is constructed in relation to expected or achieved returns, investment holdings, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change over time.

No representation or warranty is made to the reasonableness of the assumptions made or that all assumptions used to construct the performance provided have been stated or fully considered.

Hypothetical performance results have many inherent limitations and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Moreover, all hypothetical results are presented gross of fees throughout this presentation.

The use of hypothetical performance is subject to inherent limitations derived from the reliance on historical data and the benefit of hindsight. All trading strategies applied to the analysis were available throughout the performance period. However, the analysis includes certain assumptions where actual performance could be different from the hypothetical performance presented.

The information presented may include assumptions based on hypothetical scenarios. These assumptions are used to illustrate how certain investment strategies, models, or projections might perform under specific conditions.

These assumptions are theoretical and intended to provide a conceptual framework for understanding how certain investment strategies or models might operate under idealized conditions. These assumptions do not reflect actual market conditions or specific investor circumstances. Hypothetical scenarios may simplify complex market dynamics and investor behaviors. They may not fully capture the impact of variables such as market volatility, liquidity constraints, or transaction costs. The assumptions used may have inherent limitations and may not accurately represent future market conditions or investor experiences. They are designed for illustrative purposes only and should not be interpreted as predictive of actual performance or outcomes.

There is no guarantee that actual results will match the outcomes suggested by these hypothetical assumptions. Real-world investing involves risks and uncertainties that may differ from the assumptions made in these scenarios. Investors should carefully consider their own financial situation, risk tolerance, and investment goals before making decisions based on hypothetical assumptions. It is recommended to consult with a financial advisor to understand how these assumptions might apply to actual investment scenarios.

Certain information contained in these materials has been obtained from published and non-published sources prepared by third parties, which, in certain cases, have not been updated through the date hereof. While such information is believed to be reliable, L&G – Asset Management, America has not independently verified such information, nor does it assume any responsibility for the accuracy or completeness of such information. Except as otherwise indicated herein, the information, opinions and estimates provided in this presentation are based on matters and information as they exist as of the date these materials have been prepared and not as of any future date and will not be updated or otherwise revised to reflect information that is subsequently discovered or available, or for changes in circumstances occurring after the date hereof. L&G – Asset Management, America’s opinions and estimates constitute L&G – Asset Management, America’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only.

Portfolio credit quality is calculated using a market value weighted average, based on the conservative average of Moody’s, S&P, and Fitch ratings expressed in Moody’s nomenclature. If all three ratings agencies rate the security, it is the middle of the three, if two, the lower of two, and if one, that becomes the rating.

Unless otherwise stated, references herein to "L&G", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser) , Legal & General Investment Management Japan KK (licensed by the FAS in Japan), and LGIM Singapore Pte. Ltd. (licensed by the MAS in Singapore).

LGIMA claims compliance with the Global Investment Performance Standards (GIPS®). Please contact LGIMA at 312.585.0300 to obtain a GIPS Composite Report for the strategy presented in this advertisement. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.