Props for Private Credit

A prolonged higher-for-longer rates regime is supportive for private credit returns, in our view. Sub-investment grade (IG) direct lending yield (c.10% currently) remains high in absolute terms, although only average relative to history.1 IG private credit yields (c.5-7%) are pricing towards the top of the historical range, offering potentially attractive returns.2

Similar to public markets, private credit spreads are relatively tight—although the illiquidity premium has been stable so far in 2025. We are seeing increasing dispersion, with borrowers insulated from tariff volatility experiencing limited effect on pricing, while those more impacted or of lower credit quality need to offer wider spreads to attract lender demand. We prefer to be defensive in the current environment—non-cyclicals over cyclicals—and focus on diversification.

We view private credit as relatively sheltered from the recent macro volatility—at least in terms of direct tariff impact. A large chunk of IG private credit is infrastructure, utilities and real estate issuers, all of which are supported by highly predictable cashflows. Sub-IG borrowers, meanwhile, are concentrated in companies with domestic operations and service-based revenue, rather than goods-based. Direct exposure to tariff impact has been estimated at around 10%.3

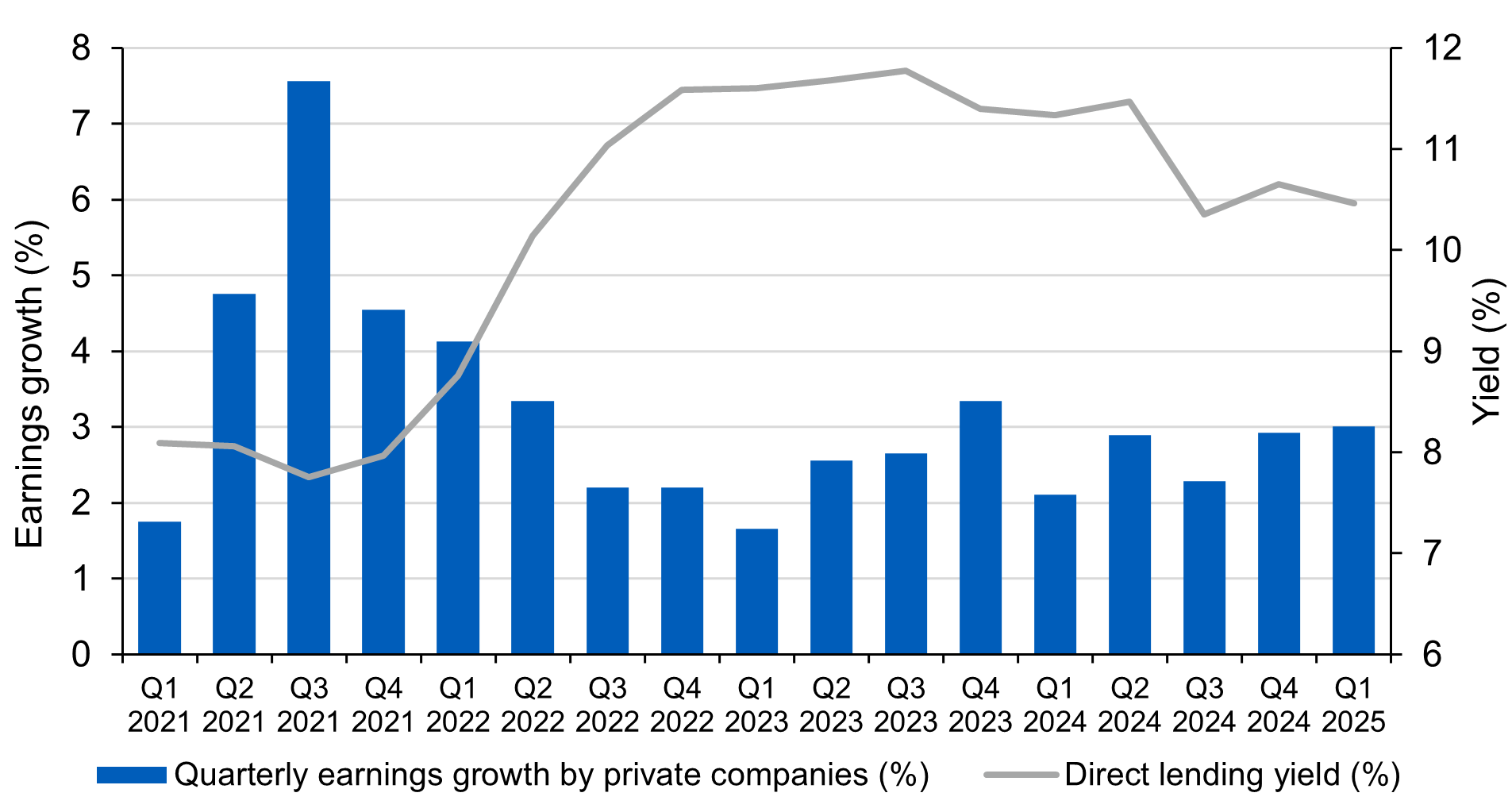

Fundamentals have been robust, with earnings growth capable of managing leverage in a higher rate environment so far. But prolonged trade tensions and fiscal concerns will have a broader influence and add to overall risk for the asset class.

Figure 1: Fundamentals remain robust as private credit borrowers managed through higher borrowing costs

Source: Q1 2025 Lincoln Private Market Index. Data as of April 2025.

We believe that cost increases, lower demand and more uncertainty for business planning will likely hit earnings growth, leading to weaker borrowers breaching debt covenants. We see smaller companies as disproportionally impacted, due to limited pricing power and revenue diversification. Another source of risk is the 2021-2022 vintage of loans—originated when yields were low and leverage high. They are coming up for refinancing in 2025-26 and could struggle due to higher debt costs and a weak M&A market.

All these factors raise concerns of an increase in defaults and represent a big test for the covenant-loose loans that have dominated direct lending issuance in recent years.

1. Source: L&G as of May 2025.

2. ibid.

3. Source: KBRA and Fitch.

This article is based on content from L&G Asset Management’s midyear global outlook.

Disclosures

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the “Offering Materials”) that will be furnished to prospective investors. Before making an investment decision, investors are advised to carefully review the Offering Materials, and to consult with their tax, financial and legal advisors. L&G – Asset Management, America does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects L&G – Asset Management, America’s views as of the date hereof and may be changed in response to L&G – Asset Management, America’s perception of changing market conditions, or otherwise, without further notice to you. Accordingly, the information herein should not be relied on in making any investment decision, as an investment always carries with it the risk of loss and the vulnerability to changing economic, market or political conditions, including but not limited to changes in interest rates, issuer, credit and inflation risk, foreign exchange rates, securities prices, market indexes, operational or financial conditions of companies or other factors. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance or that L&G – Asset Management, America’s investment or risk management process will be successful.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

In certain strategies, L&G – Asset Management, America might utilize derivative securities which inherently include a higher risk than other investments strategies. Investors should consider these risks with the understanding that the strategy may not be successful and work in all market conditions.

Reference to an index does not imply that an L&G – Asset Management, America portfolio will achieve returns, volatility or other results similar to the index. You cannot invest directly in an index, therefore, the composition of a benchmark index may not reflect the manner in which an L&G – Asset Management, America portfolio is constructed in relation to expected or achieved returns, investment holdings, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility, or tracking error targets, all of which are subject to change over time.

No representation or warranty is made to the reasonableness of the assumptions made or that all assumptions used to construct the performance provided have been stated or fully considered.

Hypothetical performance results have many inherent limitations and no representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

The use of hypothetical performance is subject to inherent limitations derived from the reliance on historical data and the benefit of hindsight. All trading strategies applied to the analysis were available throughout the performance period. However, the analysis includes certain assumptions where actual performance could be different from the hypothetical performance presented.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.