Never Mind the Ballots

The muted reaction to this November's election may not last.

After a summer where it has been anything but politics as usual in the US, the race for the White House is back to being a veritable coin flip. At a high level, risk markets have seemingly yet to take much notice of the preelection gyrations, although there are signs of sector rotations and reflation trades beneath the surface.

However, the muted reaction may not last. Against a backdrop of slowing economic growth and an impending fiscal cliff, the upcoming election is poised to be especially important for markets, particularly if the result is a sweep by one party. In one sense, not much has changed over the past three months.

In the period since Kamala Harris became the presumptive Democratic nominee, both polling and prediction markets have shifted significantly in her party’s favor. However, over a longer timeframe, the odds for various outcomes (Republican sweep, Democratic sweep, or divided government) remain largely unchanged from June – before the first presidential debate, when Joe Biden was still leading the Democratic campaign.

Not surprisingly, most of the market's focus has been on a second ‘Trump trade’, with many economists and strategists publishing detailed views on his trade, immigration and tax-cut proposals.

The Harris trade

In comparison, there has been relatively little attention on a corresponding ‘Harris trade’, with investors likely assuming a continuation of the Biden agenda should she prevail. However, that could be a mistake given that Harris has not fully outlined her policy platform. The one policy Harris has recently promoted – taxing unrealized capital gains for the ‘ultra wealthy’ – indicates she is willing to depart from the program of the previous administration.

The government’s budget deficit is a central issue in American politics. However, it may not be much affected by either a Trump or Harris trade. Neither candidate has expressed a preference for fiscal austerity: Harris is advocating for higher social spending, while Trump is expected to push for an extension and possible expansion of the Tax Cuts and Jobs Act, which is set to expire in 2025.

As a result, the potential for November’s election to create significant market volatility increases should the outcome be a sweep by either party – an outcome that appears more likely than not, given the long-term decline in split-ticket voting and the observed correlation in polling errors. Furthermore, there is every reason to think the next administration will find it easier to pass more partisan legislation as the willingness to eliminate the Senate filibuster has increased alongside a steady decline in the numbers of centrist members such as Senators Sinema of Arizona and Manchin of West Virginia.

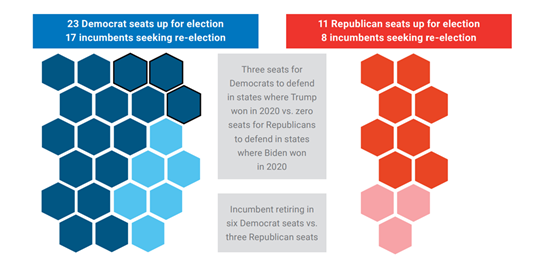

Figure 1: Senate map heavily favors Republicans in 2024

Source: senate.gov. Data as of August 2024. For illustrative purposes only.

A tough in-tray

Whoever wins, the next president will likely face a growing set of challenges next year. Immigration has slowed significantly over the summer; both candidates now advocate for stricter border enforcement. Politics aside, fewer immigrants will create headwinds for consumer demand and labor supply. Meanwhile, the next president will also find it difficult to replicate the fiscal tailwind created by the Inflation Reduction Act and CHIPs Act.

Regardless of the election outcome, 2025 is shaping up to be a more challenging year for the US economy than 2024 has been. Markets may be taking a sanguine attitude to the political events to come, but all the ingredients are present to produce the same sort of cross-asset volatility experienced in 2016 – but with far less certainty over which direction risk assets might move.

Disclosures

This material is intended to provide only general educational information and market commentary. This material is intended for Institutional Customers. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material contained here is confidential and intended for the person to whom it has been delivered and may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

The material in this presentation regarding Legal & General Investment Management America, Inc. (“LGIMA”) is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation, and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. LGIMA does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects LGIMA’s views as of the date hereof and may be changed in response to LGIMA’s perception of changing market conditions, or otherwise, without further notice to you.

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), LGIM International Limited (a U.S. SEC registered investment adviser and U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.