CIO Insight: Investing Implications of a New World Order

We see a potential global regime shift, which our economists call the return of “realpolitik.” After decades of globalization and the spread of liberal democracy post the Cold War, we’re seeing countries turn inward, prioritizing power, security and self-interest over ideals and efficiency.

The shift toward a return of realism in international affairs comes as Russia and China didn’t liberalize as hoped following the optimism of the 1990s, economic integration didn’t guarantee peace and alliances frayed.

What does that mean in practice? International relationships are becoming more transactional—less about building long-term partnerships, more about deals that serve immediate national interests. Economic decisions aren’t always “rational,” they are strategic and sometimes even protectionist.

For investors, this new era has implications.

Diversification looks more appealing. If countries and regions are moving at different speeds, market correlations may reduce. The market dynamics we have seen for the last 20 years of increasing coordination have been replaced by more regional unpredictability.

Strategic sectors are in the spotlight. Certain industries are becoming national priorities—for example energy, defense and technology. These aren’t just economic sectors anymore; they’re political priorities. Governments are investing, protecting, and sometimes even subsidizing these areas to secure their own interests.

Investors are becoming more sensitive to macro and political risks. Overall, while equities and credit have weathered the recent storm so far, the ledge is narrowing, and markets remain vulnerable to negative surprises if the US shutdown persists or inflation data disappoints.

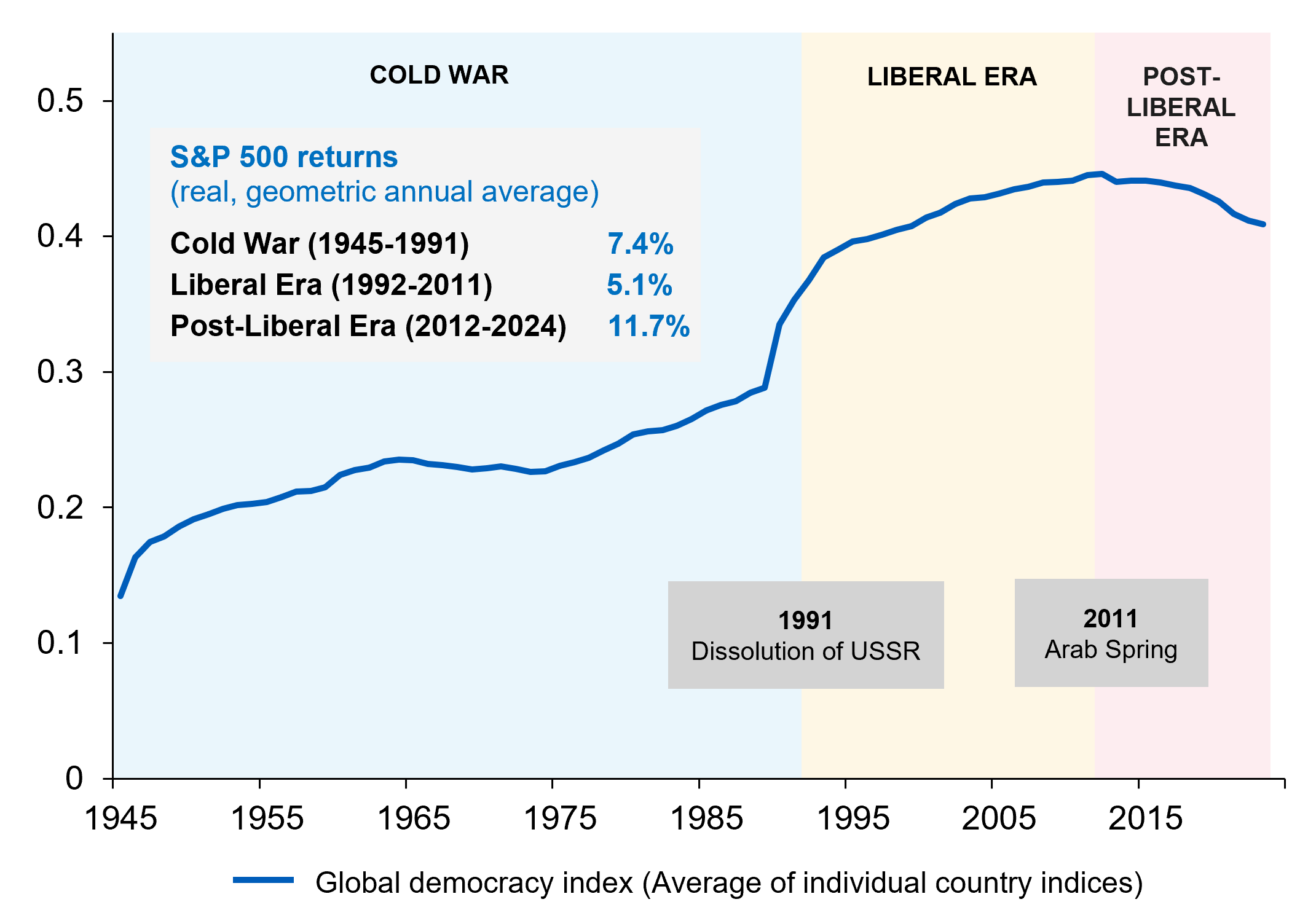

Figure 1: The End of Certainty?

From liberal optimism to geopolitical realism — the world order is shifting

Source: V-Dem. Data as of April 16, 2025. Historical returns on stocks, bonds and bills: 1928-24 (pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html) Past performance is not a guide to the future.

This CIO Insight was coauthored by Sonja Laud, Global Chief Investment Officer, and Jason Shoup, Chief Investment Officer, Asset Management, America, and Co-Head of Global Fixed Income.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.