GSE Reform: Three Guiding Principles

Surprise IPO plans for Fannie Mae and Freddie Mac could reshape US housing finance. Amid the uncertainty, three guiding principles emerge—government guarantees, market stability and retained oversight—offering clues as to what lies ahead for investors and policymakers.

President Trump’s second term has brought GSE reform back into the spotlight. The administration recently announced that it is preparing an IPO of Fannie Mae and Freddie Mac (the government sponsored enterprises or GSEs) for later this year. This development caught the market off guard—the general expectation was that an IPO would not occur until later in the administration (or beyond) to allow the GSEs time to build more capital. The full details of the IPO plan are not known, but it does appear that this issue has become a priority for the administration.

Fannie Mae and Freddie Mac play a central role in the housing finance system. The enterprises together guarantee around $6.7 trillion of mortgage-backed securities (MBS), or around 70% of the agency MBS market, which also includes bonds guaranteed by Ginnie Mae. On September 8, 2008, against the backdrop of falling home prices and rising delinquencies during the GFC, both enterprises were taken over by their regulator, the Federal Housing Finance Agency (FHFA), and placed into conservatorship.

Treasury entered into agreements with each enterprise to provide lines of credit in exchange for senior preferred stock as well as warrants to purchase 79.9% of the common stock. The expectation was that both enterprises would eventually be wound down and replaced via legislation. But all legislative efforts failed, and 17 years later, the enterprises remain under government control.

There are many unknowns regarding the future of Fannie Mae and Freddie Mac. Before the enterprises can be released from conservatorship, the administration needs to address numerous complex issues. For example, what is the appropriate level of capital that the enterprises should hold? How will Treasury’s equity stake be handled? And how much control will the government retain post-release? Any disruptions to the agency MBS market would have a negative impact on housing affordability and on the availability of credit.

Three guiding principles

Against this uncertain backdrop, it’s helpful to take stock of what we do know. Based on policymakers’ public statements, there are three guiding principles that we believe are likely to apply regardless of the path that the administration takes.

1. The GSEs will retain some form of government guarantee. The absence of credit risk is a key reason that agency MBS investors are willing to assume prepayment risk and negative convexity. And domestic banks receive favorable capital treatment on their agency MBS holdings because of the government backstop. President Trump has publicly stated that the GSEs’ implicit guarantee will continue post-IPO. This may mean that the lines of credit with Treasury will remain in place, or perhaps there will be additional support.

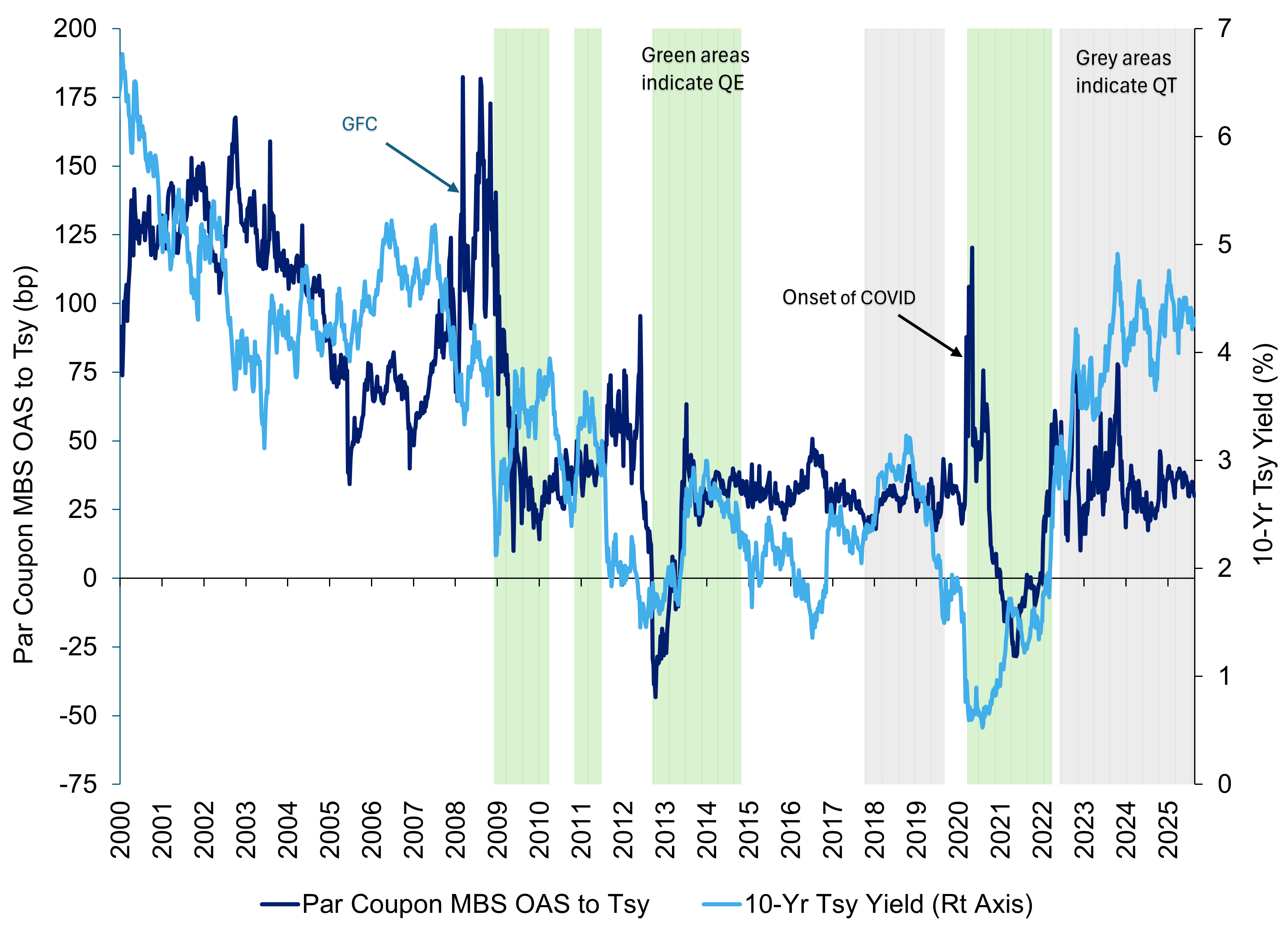

2. Mortgage market liquidity and depth must be preserved. Treasury Secretary Bessent has stated that privatization must be accomplished without widening the spread between the primary rate and the risk-free rate. Primary mortgage rates are directly tied to pricing in the TBA market, which accounts for the bulk of secondary mortgage market trading. Mortgage spreads over the risk-free rate are a function of many factors including the macro backdrop and technicals as well as liquidity and perceived credit risk (see Figure 1). To avoid increasing mortgage rates, the administration must work to avoid TBA market disruptions.

Figure 1. Mortgage spreads vary widely based on market conditions

Source: Bloomberg, Federal Reserve and L&G. Data as of August 2025. Past performance is not a guarantee of future results.

3. The government will likely retain significant control post-IPO. While legislative efforts at GSE reform have failed, many changes have been made through administrative means. The enterprises’ investment portfolios have shrunk; UMBS was launched; the credit risk transfer market was established; the structure of guarantee-fees was revamped; and prohibitions were placed on lobbying. Many of these reforms are now integral to the US housing finance system. To prevent their discontinuation after privatization, some level of government control will need to be maintained, at least until each reform is fully evaluated and codified, as needed. Indeed, FHFA Director Pulte has stated that the enterprises will likely remain in conservatorship post-IPO.

A pivotal moment

The Trump administration’s push to privatize Fannie Mae and Freddie Mac marks a pivotal moment in US housing finance. As the administration works through the many dimensions of GSE reform, temporary market disruptions may be inevitable along the way. But we believe that policymakers’ public comments should reassure MBS investors that the administration will likely take a thoughtful and deliberate approach.

Preserving the GSEs’ guarantees and ensuring liquidity in the TBA market will be critical in order to avoid exacerbating already stretched housing affordability. Given the importance of the MBS market to US housing and to the electorate, policymakers cannot afford to make a market-breaking error. Ultimately, success hinges on balancing innovation with stability—ensuring that privatization strengthens, rather than destabilizes, the housing system.

Priya Joshi, Senior Research Analyst, MBS, L&G – Asset Management, America, authored this blog.

Disclosures

Legal & General Investment Management America, Inc. (d/b/a L&G – Asset Management, America) (“LGIMA”, “LGIM America”) is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”). LGIMA provides investment advisory services to U.S. clients. L&G’s asset management division more broadly—and the non-LGIMA affiliates that comprise it—are not registered as investment advisers with the SEC and do not independently provide investment advice to U.S. clients. Registration with the SEC does not imply any level of skill or training.

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the “Offering Materials”) that will be furnished to prospective investors. Before making an investment decision, investors are advised to carefully review the Offering Materials, and to consult with their tax, financial and legal advisors. L&G – Asset Management, America does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects L&G – Asset Management, America’s views as of the date hereof and may be changed in response to L&G – Asset Management, America’s perception of changing market conditions, or otherwise, without further notice to you. Accordingly, the information herein should not be relied on in making any investment decision, as an investment always carries with it the risk of loss and the vulnerability to changing economic, market or political conditions, including but not limited to changes in interest rates, issuer, credit and inflation risk, foreign exchange rates, securities prices, market indexes, operational or financial conditions of companies or other factors. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance or that L&G – Asset Management, America’s investment or risk management process will be successful.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

Unless otherwise stated, references herein to "L&G", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser) , Legal & General Investment Management Japan KK (licensed by the FAS in Japan), and LGIM Singapore Pte. Ltd. (licensed by the MAS in Singapore).

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.