CIO Insight: AI to the Rescue?

The view that artificial intelligence (AI) will boost productivity and prove transformative to the economy is one of the market narratives contributing to a sanguine backdrop for risk assets, even as soft patches in the economy become more pronounced.

Research from Goldman Sachs and others suggests AI is already adding 0.1-0.3% to US gross domestic product (GDP), with more upside likely through productivity gains. While equity valuations reflect enthusiasm—especially for hyperscalers and infrastructure providers—the real test lies in corporate deployment of AI.

If AI can sustainably boost GDP by 0.5-1%, weak payroll growth may be less concerning and even a necessary byproduct of adoption. Long term, lifting US trend growth from 1.5-2% to 2.5-3% would significantly improve US debt sustainability.

Next year’s supply avalanche

AI-related spending is already playing an outsized role in overall economic momentum. AI investment is set to surge from here, with Morgan Stanley estimating $3 trillion in capex from hyperscalers over the next three years—only half funded by free cash flow. That may understate the scale, in our view. The forecast also excludes massive infrastructure needs in power and grid capacity.

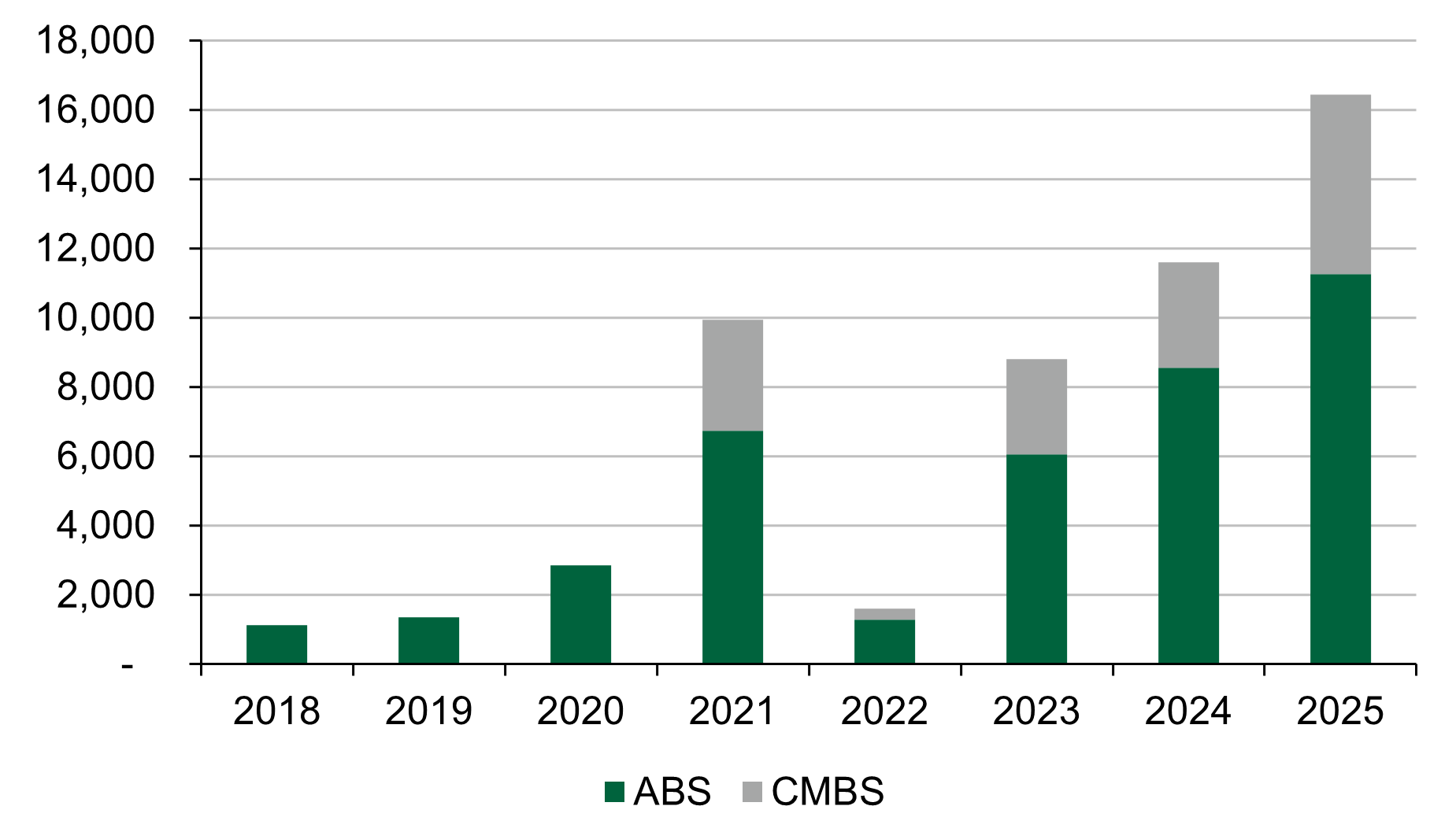

This wave of spending implies a significant fixed income financing requirement, spanning private credit, securitized, and public issuance. While much will be off-balance-sheet and outside investment grade (IG) debt, overall US fixed income supply is poised to rise sharply, particularly when compared to recent years. Case in point: Data center securitization gross issuance for 2025 year to date has already outpaced prior years, as Figure 1 shows. Combined with persistent fiscal deficits, the success of AI and the health of the US economy appear increasingly intertwined.

With AI already contributing to growth, our base case is that the US economy remains resilient despite shocks from tariffs and political uncertainty, though delayed effects may emerge in late 2025 or early 2026. For credit markets, this base case supports valuations in the near term, though risks are skewed to the downside. Longer term, rising fixed income supply may erode favorable supply / demand technicals.

Figure 1: Data Center Securitization is on the Rise

Data center securitization gross issuance ($ millions)

Source: Barclays, L&G – Asset Management, America. Data as of September 2025. Numbers are estimates and likely exclude deals that are privately placed in the 4(a)(2) market. CMBS refers to commercial mortgage-backed securities. ABS refers to asset-backed security debt.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.