A Rebuttal of Rebalancing Downsides

A paper that made headlines earlier this year suggested that predictable rebalancing strategies may cost investors several basis points of return, which, at a global institutional scale, “translate[s] into an estimated annual cost of $16 billion.”1 It’s a great paper worth reading, in our view.

However, the authors acknowledge that the modeled results may not be the full story, and we agree. Our experience and analysis of practitioner data tell a different story, and even if we assume rebalancing does come with added portfolio risk, we find that it is a sensible risk to take, if not also a rewarding one.

Rebalancing and month-end returns in practice

Several market counterparties produce estimates of the notional value of equities to be bought or sold by institutional investors at the end of each month. These estimates tend to be highly correlated across providers, as we would expect.

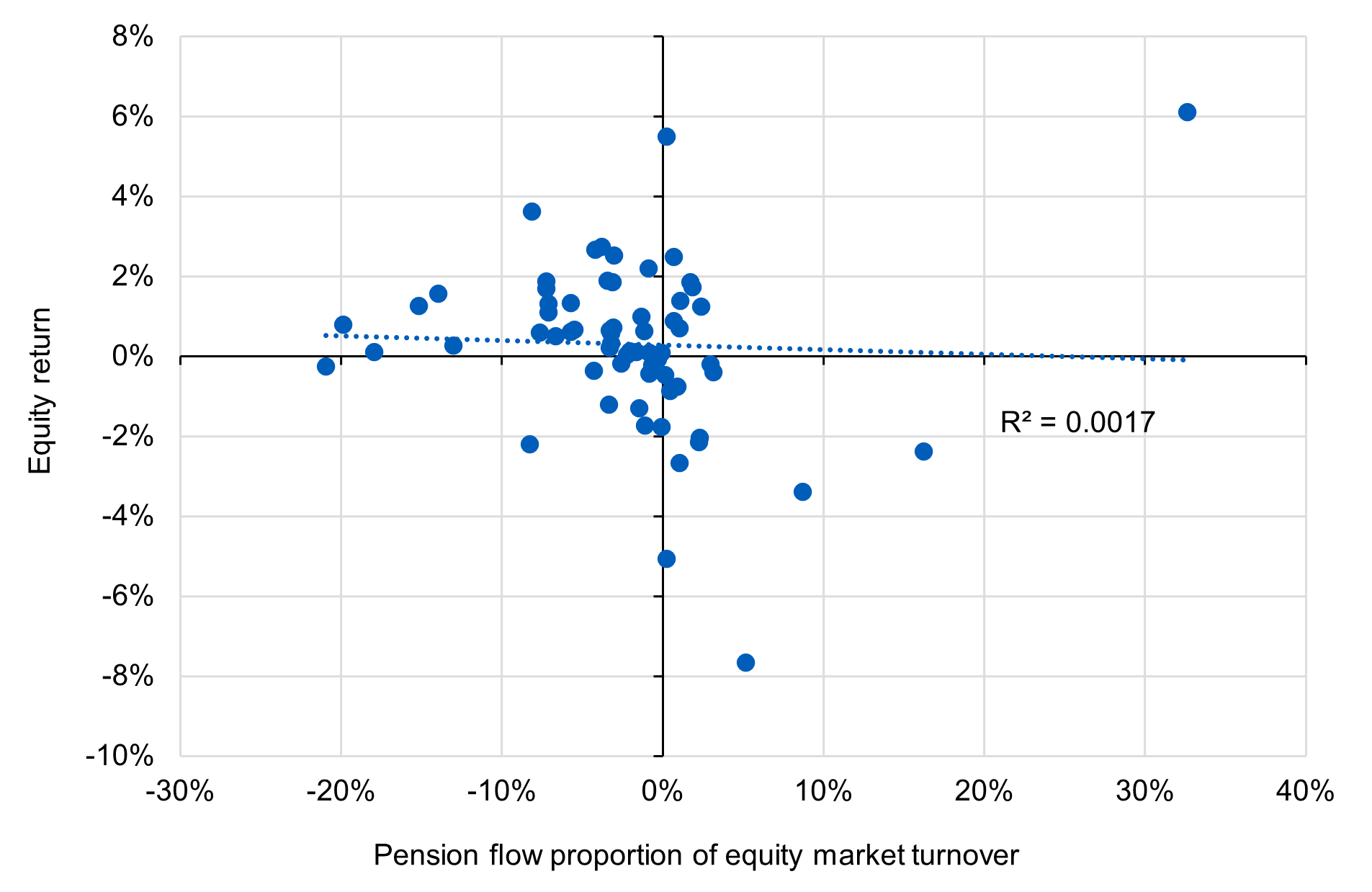

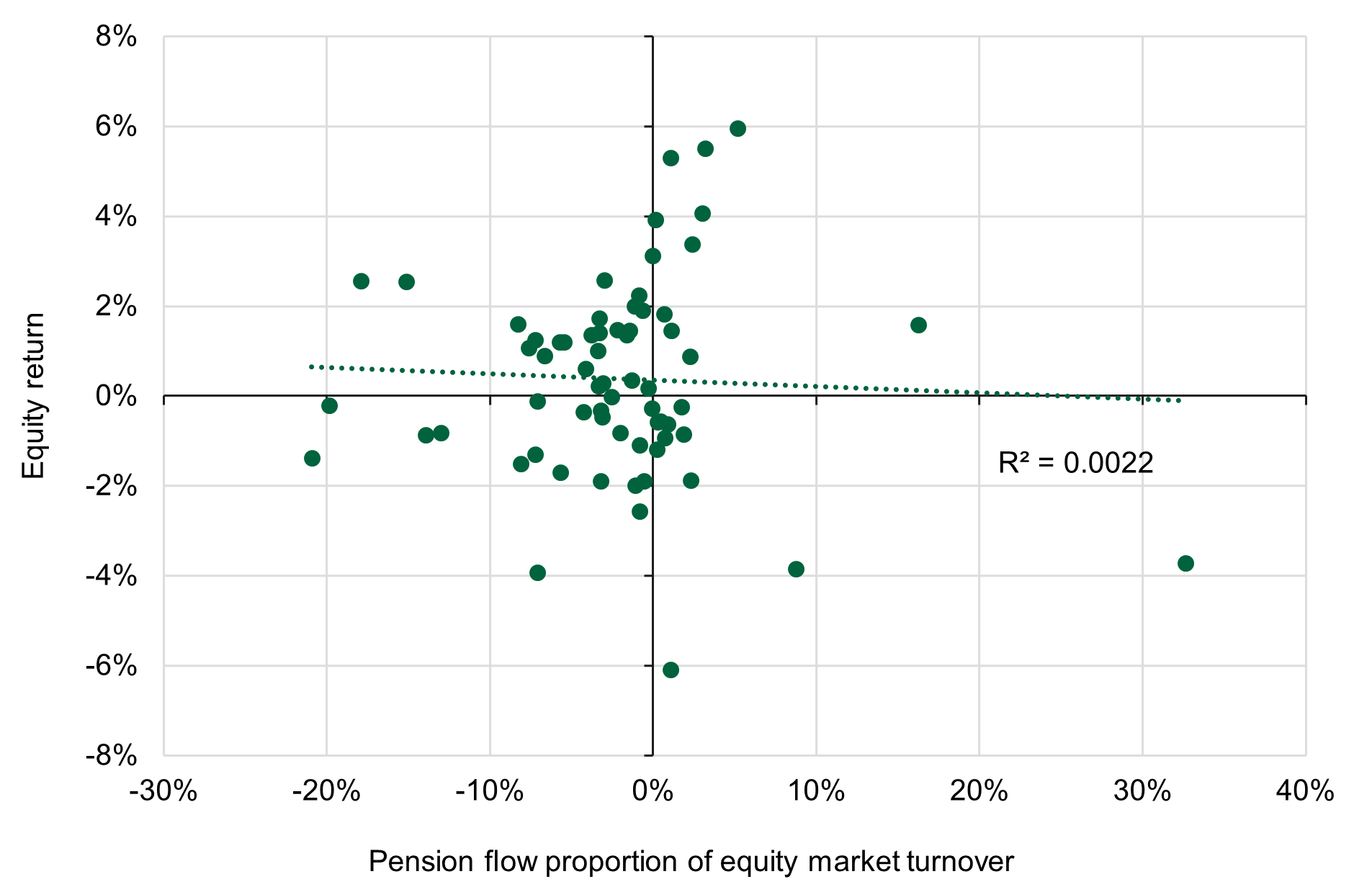

In Figures 1 and 2 below, we utilize estimates of equity rebalancing by institutional investors as provided by Goldman Sachs. First, we normalize the estimated rebalance flow by the total equity market turnover on those month-end dates. This adjusts for the significance of the rebalance trade relative to all other market participants’ trading. Then we utilize the S&P 500 as a proxy and calculate equity returns for the three-day periods just prior and just following month-end.

To be consistent with the paper’s model, we would expect reasonably strong positive correlation between the three-days prior and the magnitude of institutional rebalancing (e.g., more positive returns when estimates are for institutions to buy more equity at month-end), and negative correlation between the rebalancing estimate and subsequent returns as a result of the reversal effect identified in the paper’s introduction. Observations from January 2020 through June 2025 reveal no such relationships.

Figure 1: Three days pre rebalancing

Source: Goldman Sachs, Bloomberg, L&G calculations. Data represent the period January 31, 2020 to June 30, 2025.

Figure 2: Three days post rebalancing

Source: Goldman Sachs, Bloomberg, L&G calculations. Data represent the period January 31, 2020 to June 30, 2025.

The lack of an observable relationship is consistent with our real-world experience. That said, there are a myriad of variables and influencing factors that help reconcile the model predictions and our empirical results. For example, the model used in the paper assumes a target asset allocation: 60% equity, 40% bonds. Market participants are much more heterogenous both in their asset mixes and rebalancing and trading strategies.

The paper also cleverly incorporates a control variable for momentum in pension rebalancing as they are strongly negatively correlated, with positive equity momentum often leading to pensions selling equities. However, the heterogeneity of market participants also means some employ investment strategies without fixed weights, namely systematic strategies and commodity trading advisors (CTAs). The influence of CTAs and other momentum-based strategies has grown markedly in recent years, and their demand for equities in a rising market could be more than offsetting the impact of rebalance flows.

Further, the paper uses data beginning in 1997. While our data set is shorter, over the longer horizon there have been many significant changes and trends that affect institutional flows. This includes the equity settlement cycle shrinking from three days (as recently as 2017) to just one in 2024. This will have changed the rebalancing notification and trading cycle commensurately. We have also seen a significant shift into private assets, and it is common to use a public asset counterpart to help balance liquidity. For example, an institution may manage public and private equity to a single overall equity allocation target in the portfolio. As private valuations lag, a pension may not need to sell public equity even after strong returns until those private valuations catch up. So, some diversifying assets simply can’t be rebalanced and might constrain others that can.

Rebalancing utility and cash flows

We agree that there are utility gains from rebalancing for a given level of risk aversion. Simply put, paying a unit of rebalancing cost can be worth it if it saves units of unintended risk. That unintended risk is tracking error associated with not aligning the portfolio with its strategic asset allocation. We demonstrated in a September 2023 whitepaper that unintended tracking error erodes portfolio value, especially in the case of cash outflows (which is the case for most corporate and public pensions).2 Rebalancing thus can be a sensible, and rewarding, risk to take that delivers measurable value to investors.

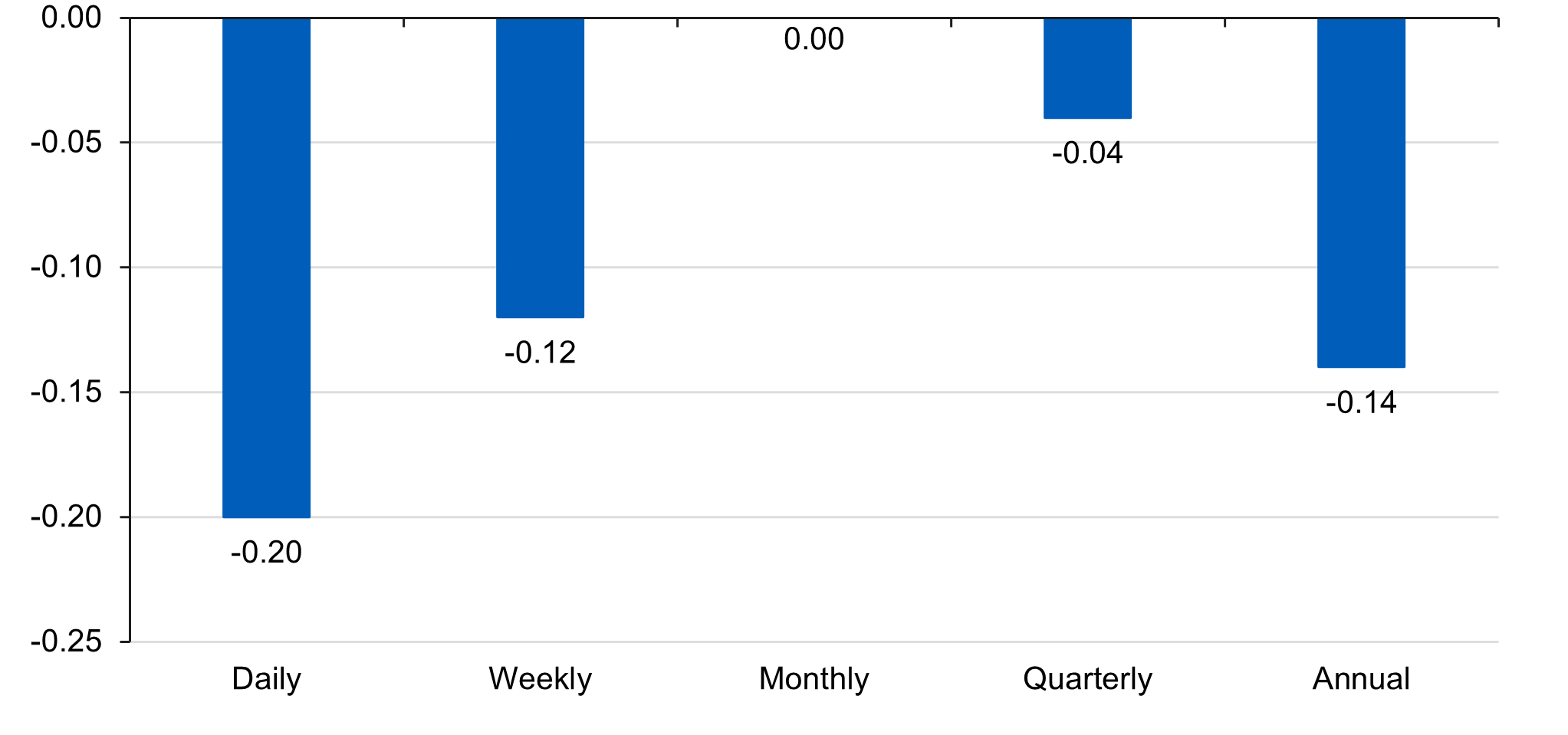

Figure 3 shows the annual performance impact of geometric returns compounded on any basis other than monthly relative to the monthly measurements. So, for example, if performance is measured monthly but the portfolio is rebalanced weekly, there is an expected return impact of -12 basis points. This approach applies to any volatility not calibrated to the performance benchmark, whether that is driven by misweights and/or an irregular rebalance cadence (which are effectively the same thing). Said differently, if performance is measured quarterly, there will be a volatility drag from rebalancing on any frequency other than quarterly, or weekly versus weekly, and so on. Rebalancing utility is real and not merely theoretical. The positive effects of rebalancing on compounding returns can offset the impact of each month’s potential rebalance front-running impact.

Figure 3: The impact of volatility differences on returns (%)

Source: Bloomberg, L&G calculations. Data represent the period December 31, 1996 to June 30, 2025. Assumes a 60/40 blend of S&P 500 Total Return Index (SPTR) and Bloomberg Barclays US Aggregate Total Return Index (LBUSTRUU) rebalanced to the fixed weights according to the frequency indicated.

Room for improvement

Even if the costs modeled in the paper are real, we think there are better ways to address them than reevaluating rebalancing policies. We believe these costs can potentially be reduced by utilizing a policy overlay, while also maintaining pre-scheduled rebalancing. We strive to be flexible and dynamic when managing policy overlays. This includes using cash flows to rebalance portfolios naturally; evaluating relative value across transaction and carry costs of cash-based and derivative instruments; and maintaining a strong partnership and clear communication to understand all aspects of a client’s portfolio. These actions may help naturally avoid month-end congestion, and they can potentially add value by using different instruments to rebalance a portfolio.

- Harvey, Campbell R. Mazzoleni, Michele and Melone, Alessandro, The Unintended Consequences of Rebalancing (January 28, 2025). Fisher College of Business Working Paper No. 2025-03-001, Charles A. Dice Center Working Paper No. 2025-01, Available at SSRN: https://ssrn.com/abstract=5122748.

- https://am.landg.us.com/asset/4a7f2a/globalassets/lgima/insights/whitepapers/optimizing-ldi-strategies.pdf/

Disclosures

Legal & General Investment Management America, Inc. (d/b/a L&G – Asset Management, America) (“LGIMA”, “LGIM America”) is a registered investment adviser with the U.S. Securities and Exchange Commission (“SEC”). LGIMA provides investment advisory services to U.S. clients. L&G’s asset management division more broadly—and the non-LGIMA affiliates that comprise it—are not registered as investment advisers with the SEC and do not independently provide investment advice to U.S. clients. Registration with the SEC does not imply any level of skill or training.

The material in this presentation regarding L&G – Asset Management, America is confidential, intended solely for the person to whom it has been delivered and may not be reproduced or distributed. The material provided is for informational purposes only as a one-on-one presentation and is not intended as a solicitation to buy or sell any securities or other financial instruments or to provide any investment advice or service. Where applicable, offers or solicitations will be made only by means of the appropriate Fund’s confidential offering documents, including related subscription documents (collectively, the “Offering Materials”) that will be furnished to prospective investors. Before making an investment decision, investors are advised to carefully review the Offering Materials, and to consult with their tax, financial and legal advisors. L&G – Asset Management, America does not guarantee the timeliness, sequence, accuracy or completeness of information included. The information contained in this presentation, including, without limitation, forward looking statements, portfolio construction and parameters, markets and instruments traded, and strategies employed, reflects L&G – Asset Management, America’s views as of the date hereof and may be changed in response to L&G – Asset Management, America’s perception of changing market conditions, or otherwise, without further notice to you. Accordingly, the information herein should not be relied on in making any investment decision, as an investment always carries with it the risk of loss and the vulnerability to changing economic, market or political conditions, including but not limited to changes in interest rates, issuer, credit and inflation risk, foreign exchange rates, securities prices, market indexes, operational or financial conditions of companies or other factors. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance or that L&G – Asset Management, America’s investment or risk management process will be successful.

Certain information contained in this document constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “seek,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

Unless otherwise stated, references herein to "L&G", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser) , Legal & General Investment Management Japan KK (licensed by the FAS in Japan), and LGIM Singapore Pte. Ltd. (licensed by the MAS in Singapore).

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.