CIO Insight: Déjà Vu in July Data?

This year’s weak July labor report echoes last year’s summer slowdown, which reversed in September and October data. Last year’s data head-fake significantly undercut the Federal Reserve’s rationale for delivering the first rate cut of 50 basis points in August 2024, ahead of the US election. We do not think 2025’s hiring slowdown will be reversed this Fall. A look under the hood at the data suggests a stiff challenge to the resilient labor market narrative, with meaningful cracks emerging.

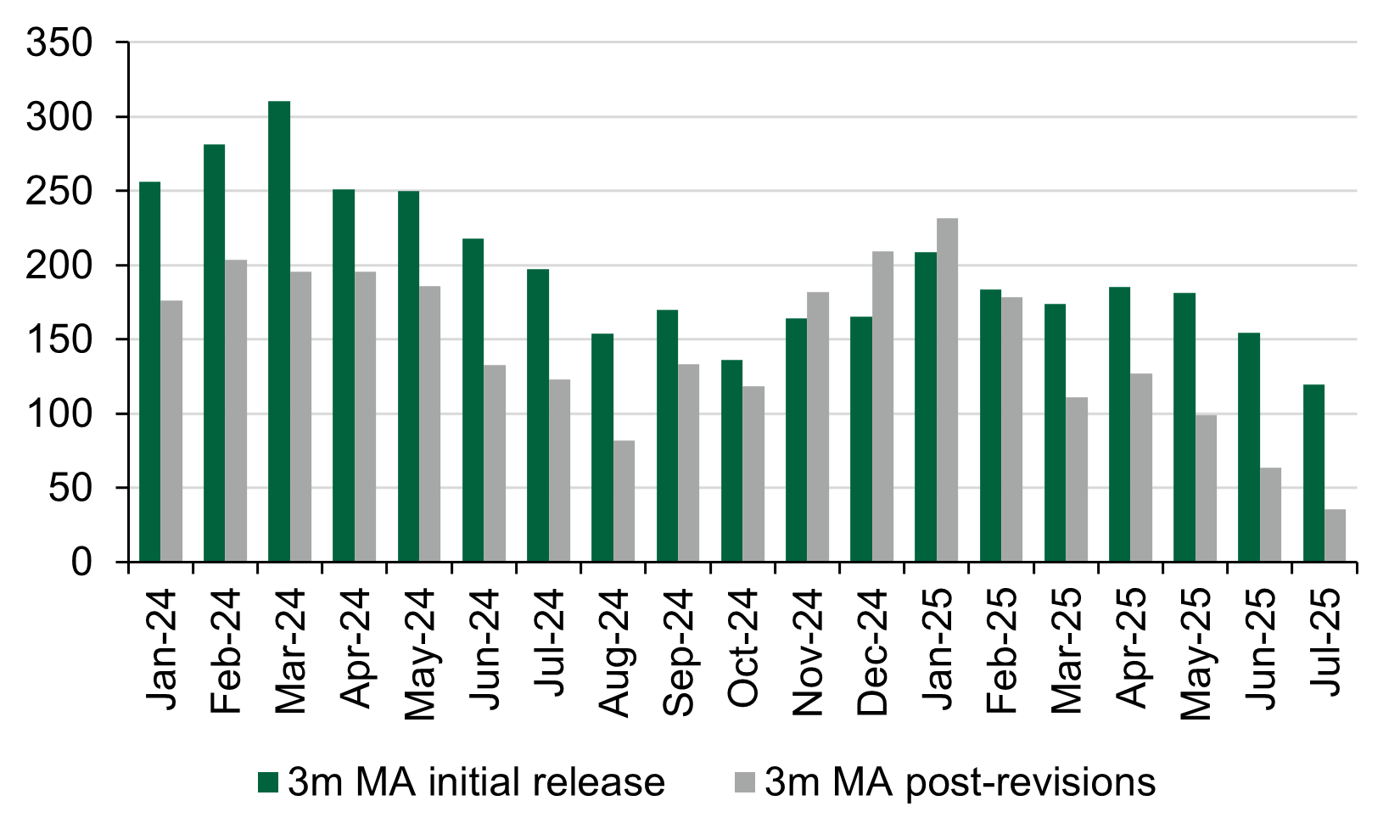

Following significant downward revisions to non-farm payrolls, job growth has slowed to approximately 35k per month, with gains concentrated in health care and government—highlighting fragility in broader employment. Immigration policy is masking what might otherwise be a rising unemployment rate. Demand for labor is falling but so is supply, which means there isn’t much labor slack being created. Persistent downward revisions (data for 80% of the past 18 months have been revised downward, as Figure 1 shows), the narrow breadth of job gains so far and declining labor supply on the back of immigration policies suggest this year’s softness may be more durable.

Figure 1: A tale of two labor markets: Job gains have not been as robust as initially believed

3-month non-farm payroll (NFP) moving averages (k) pre and post revisions

Source: L&G – Asset Management, America, Bureau of Labor Statistics, Deutsche Bank Research. Data as of August 11, 2025.

Beyond labor, recent ISM data also disappointed. Economists have long warned that the economic drag from tariffs would be delayed due to exemptions and inventory strategies. Recent data may mark the first signs of tariff effects materializing—ironically, just as markets and media begin to dismiss those risks.

Will confidence crack? If growth slows to roughly 1% amid a cooler labor market and rising inflation, nominal gross domestic product (GDP) near 4% could still support long-end yield and credit demand. But the near-term question is whether valuations adequately compensate for a less favorable growth / inflation mix. If investors belatedly recognize the economic drag from second-quarter tariffs, sentiment could shift—potentially triggering a wobble in risk assets.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.