The New Era of Liability-Driven Investing

Defined benefit (DB) pension plans have long relied on liability-driven investing (LDI) to manage risk and align assets with liabilities. As the landscape of DB pension plans continues to evolve, we are entering a new era: LDI 3.0.

LDI 3.0 builds on the evolution of the strategy over the past two decades. In the early stages, plan sponsors opted to simply extend the duration of their fixed income using longer duration market-based benchmarks. In the US, the next phase of LDI involved a more customized approach to credit and Treasury strategies to better align with the liability risk profile, most commonly involving a long credit allocation and a custom Treasury portfolio to hedge interest rate risk.

As funding ratios for corporate DB plans have improved in recent years, many DB plans are fully funded or in surplus, with fixed income the dominant class within their asset allocations. As corporate DB plans mature and fixed income allocations grow, plan sponsors have more flexibility to improve diversification and potentially seek more yield while still meeting their hedging objectives.

Enter LDI 3.0, which involves broadening the fixed income toolkit beyond traditional investments to potentially enhance yield and improve diversification. It comes as more companies are planning to keep their overfunded plans compared to prior years amid growing recognition of the opportunities that exist from managing the plan in run-off mode. Indeed, according to a Mercer survey in June, 50% of US plan sponsors do not intend to terminate their DB plans in 2025, up from 36.7% in 2023.

LDI 3.0 takes its inspiration from how insurers structure their investments to balance preservation and growth objectives, widening the LDI investment toolkit to include:

- Short duration fixed income to enhance collateral efficiency and optimize liquidity and yield objectives

- Opportunistic fixed income to improve diversification and unlock uncorrelated sources of return potential

- Securitized assets for potential spread pick-up while maintaining high credit quality

- Investment grade private credit to gain yield potential and diversification

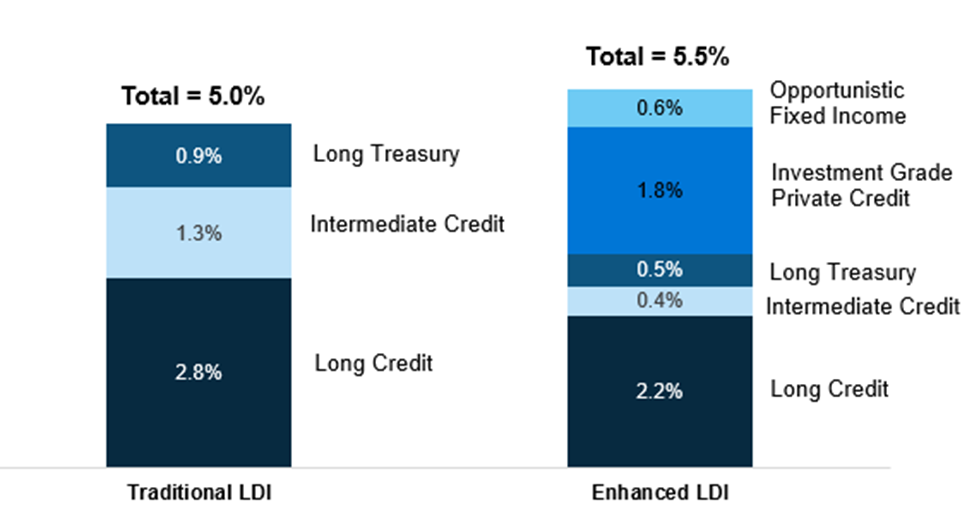

To be sure, there is no one-size-fits-all solution. Circumstances matter, and we think LDI programs should be considered from a holistic point of view. However, as Figure 1 shows, we find that the enhanced fixed income portfolios that characterize LDI 3.0 can potentially lead to enhanced yields and improved funded status outcomes while also lowering drawdown exposure.

The bottom line: LDI has long sought to minimize volatility and improve funded status outcomes. As DB plans continue to evolve and mature, so should the LDI strategy.

Figure 1: The potential yield pick-up of enhanced LDI

Source: L&G – Asset Management, America and Bloomberg. Data as of September 30, 2025. Traditional LDI represents a portfolio of 50% long credit, 30% intermediate credit and 20% custom Treasury. Enhanced LDI represents a portfolio of 40% long credit, 10% intermediate credit, 30% investment grade private credit, 10% custom Treasury and 10% opportunistic fixed income.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.