Securitized Credit Financing Data Centers: Opportunity or Hidden Risks?

As US securitized markets increasingly finance data centers, concerns about hidden risks are growing. How worried should investors be?

The race to build and operate data centers for current and anticipated AI demand is pulling in financing from multiple corners of the bond market. No single channel can satisfy the scale of capital required. Among these, US securitized credit has emerged as a key source, offering relatively attractive spreads for investors. Yet, some market participants are raising concerns about off-balance-sheet financing and structural risks. While we do see some risks beneath the surface that are important to monitor, we believe data center securitization can offer opportunity for investors.

Recent issuance trends

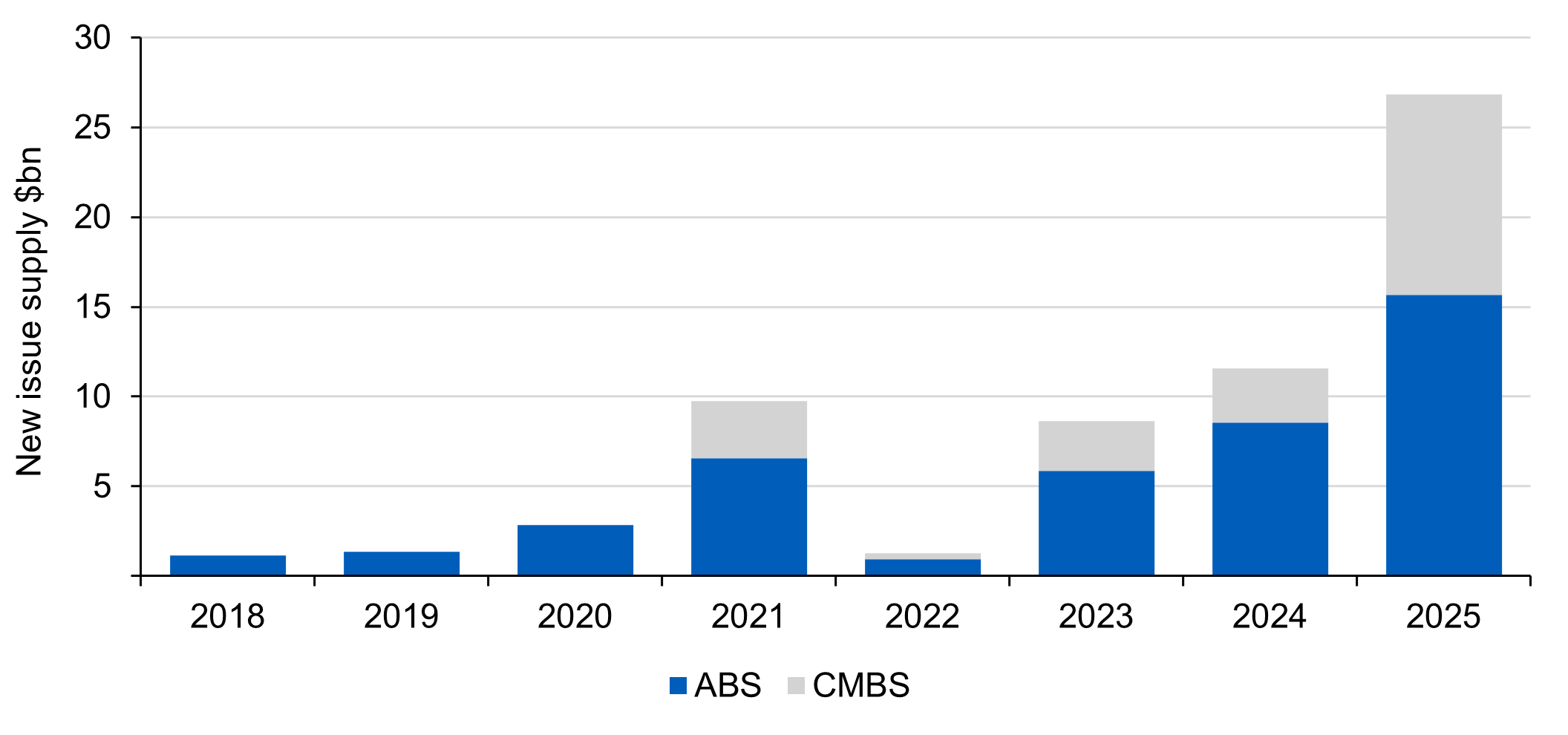

Securitized bonds backed by data centers have become one of the fastest-growing asset classes within the US securitized market. Issuance surpassed $25 billion in 2025, exceeding the combined total of the previous three years. To put this in perspective, the size of the US securitized market (ex-Government Sponsored Enterprises) is about $4.5 trillion, so small in comparison to the overall market.

Data center asset-based securities (ABS) and commercial mortgage-backed securities (CMBS) have provided operators with relatively inexpensive, long-term funding for stabilized assets. Institutional investors’ appetite for higher-quality, longer-dated paper has driven issuers to lean into this demand.

Figure 1: Data center ABS and CMBS annual issuance

Source: JP Morgan, Deutsche Bank, Bank of America, Barclays, Bloomberg. Data as of December 31, 2025.

Source: JP Morgan, Deutsche Bank, Bank of America, Barclays, Bloomberg. Data as of December 31, 2025.

It’s important that we distinguish between the financing avenues being used by different parts of the credit market for data center financing.

- Securitized credit: Typically used post-build-out for refinancing stabilized assets

- Public corporate bonds: Broader funding for large-scale operators

- Private credit: Flexible and fast access for construction-phase financing

Most securitized issuance focuses on refinancing income-generating assets rather than funding initial construction. ABS and CMBS structures suit assets with predictable cash flows —usually from long-term leases—making them ideal for refinancing once a data center is fully built and leased. In contrast, construction-phase financing relies on private credit or project finance, which can better absorb development risk.

In practice, these channels complement each other: Developers often use private credit for build-out, then refinance via securitization to lock in lower-cost, long-term funding and free up capital for new projects.

Refinancing wall

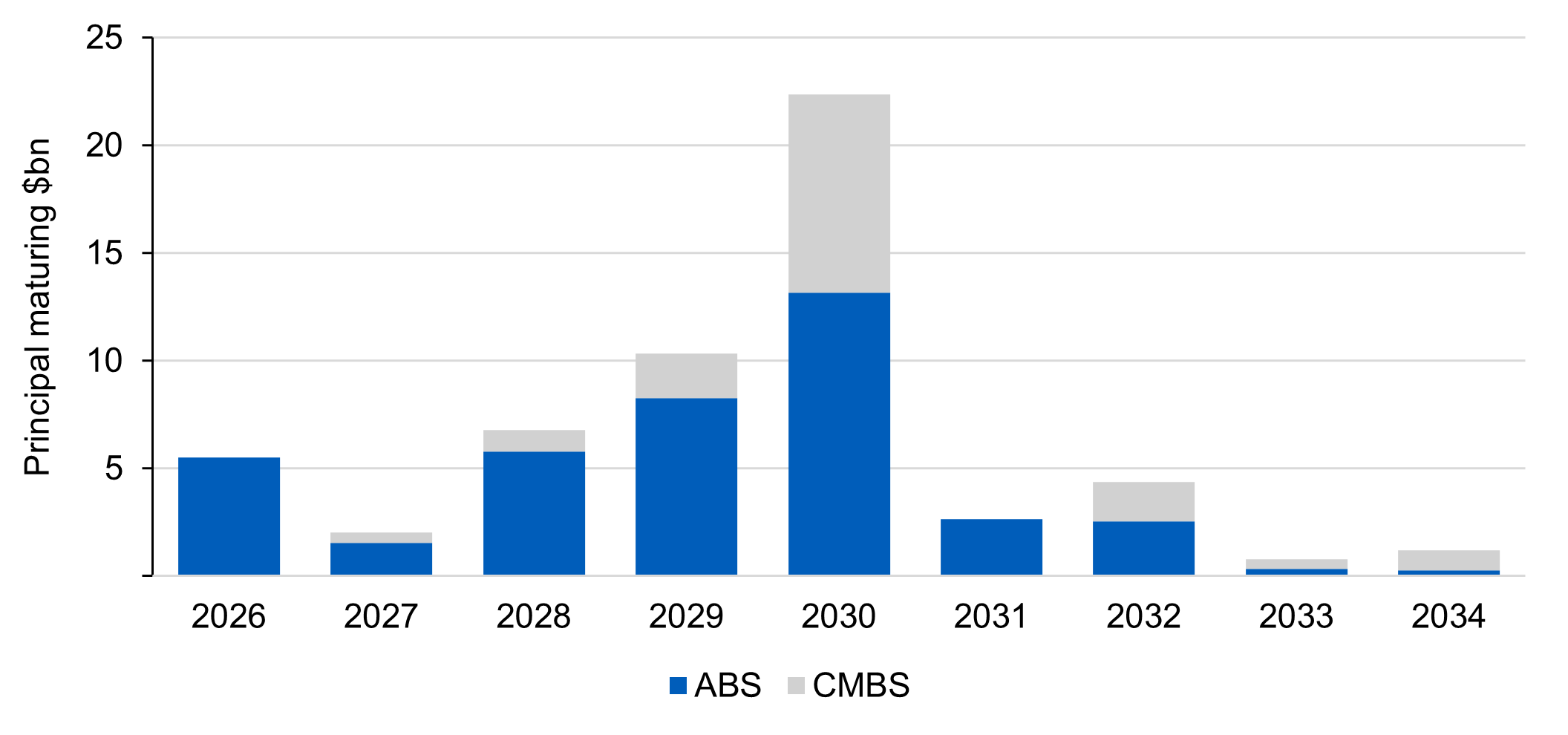

Near-term concerns about data center securitization are limited, but refinancing risk looms on the horizon, in our view. Given most transactions feature a 5-year anticipated repayment date (ARD), existing maturity walls start to become a more pressing matter in 2028-2030 (see Figure 2). If recent issuance trends persist, the ability to securitize new data centers will be critical as existing collateral ages and existing deals approach ARD.

Figure 2: Data center ABS and CMBS anticipated repayment dates (ARD)

Source: JP Morgan, Deutsche Bank, Bank of America, Barclays, Bloomberg. Data as of December 31, 2025.

Source: JP Morgan, Deutsche Bank, Bank of America, Barclays, Bloomberg. Data as of December 31, 2025.

Rewards and structural risks

We believe data center ABS and CMBS offer compelling value relative to corporate debt and other securitized products. New issue spreads on recent data center ABS transactions have priced 150-200 basis points (bps) over Treasuries and typically feature a 5-year weighted average life (WAL) and a single-A rating. These levels look attractive when compared to other securitized products such as whole business securitizations, where recent new issue spreads have priced closer to 115-130 bps over Treasuries. We prefer deals backed by operators that have scale and history, as well as assets with desirable characteristics such as location and connectivity.

While the current backdrop of strong demand and hyperscaler expansion supports the sector, several structural risks warrant attention.

- Overbuilding is a key concern. The race to deploy AI-ready facilities has led to aggressive capacity growth, but if AI model development shifts toward decentralized architectures or further relocates to regions with cheaper energy, utilization rates could fall sharply. While we are already seeing development move to secondary and tertiary markets with cheaper or available power, we are not yet seeing a fall in utilization rates in primary markets. For now, power constraints are a limiting factor in data center development. Vacancies are also at record lows, with data center demand continuing to outpace supply, especially amid cloud growth.

- Technological obsolescence compounds the risk, especially for older data centers. Data centers are long-lived assets, often exceeding 15 years, yet AI hardware such as GPUs has a short lifecycle and requires frequent refreshes. This mismatch means operators may need significant ongoing capital expenditure and retrofitting of their existing data centers to remain competitive as customers’ hardware go through future refresh cycles. If these upgrades fail to keep pace with evolving compute requirements, today’s hyperscaler investments could lose relevance well before their full economic life is realized.

- Finally, revenue uncertainty adds another layer of vulnerability. AI-driven workloads are expected to underpin growth, but if demand slows due to economic, regulatory or technological factors, lease renewals could be pressured, rental income reduced and vacancy risk elevated. While securitized deals benefit from current leases associated with traditional cloud and connectivity services, rollover periods present heightened exposure to these structural and market shifts. That said, revenue uncertainty could also inflect to the positive, as projecting AI-related demand is very challenging on a multi-year scale.

Closing thoughts

We believe data center securitization offers an attractive investment opportunity, supported by secular growth trends and appealing spreads. Cash flows also benefit from structural protections in the form of performance triggers and/or subordination and are less exposed to development risk and large-scale AI workloads. However, overbuilding, rapid technological change and uncertain revenue models introduce risks that investors must monitor closely as both the sector and asset class develop.

For those willing to navigate these challenges, we think data center securitization provides a compelling way to gain exposure to digital infrastructure—but sector expertise, disciplined underwriting, and stress-testing assumptions are essential to avoid hidden pitfalls in this highly dynamic space.

Christopher Plumb, CFA, Securitized Research Analyst with L&G - Asset Management, America, authored this blog.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.