Our Q1 MSCI Rebalancing Predictions

Ahead of each quarter’s MSCI World rebalancing, we assess the accuracy of our predictions for the prior quarter’s rebalancing and release our predictions for upcoming changes to the index. With the first-quarter 2026 rebalancing announcement set for February 10, we now look back at our fourth-quarter predictions and ahead at the approaching announcement.

For the fourth quarter, our prediction accuracy score came in solid in an environment of heightened activity. During the period, MSCI announced 25 adds and 26 deletes in the MSCI World Index, for a total of 51 total constituent changes. We correctly predicted 44 of the 51 and were fortunate enough to have no incorrect predictions. Consequently, our Rebalance Accuracy Score came in at 86.

This quarter’s activity was notably higher than in the third quarter, with 51 changes compared to 30 previously. We believe our ability to maintain accuracy in a dynamic environment reinforces the consistency of our approach.

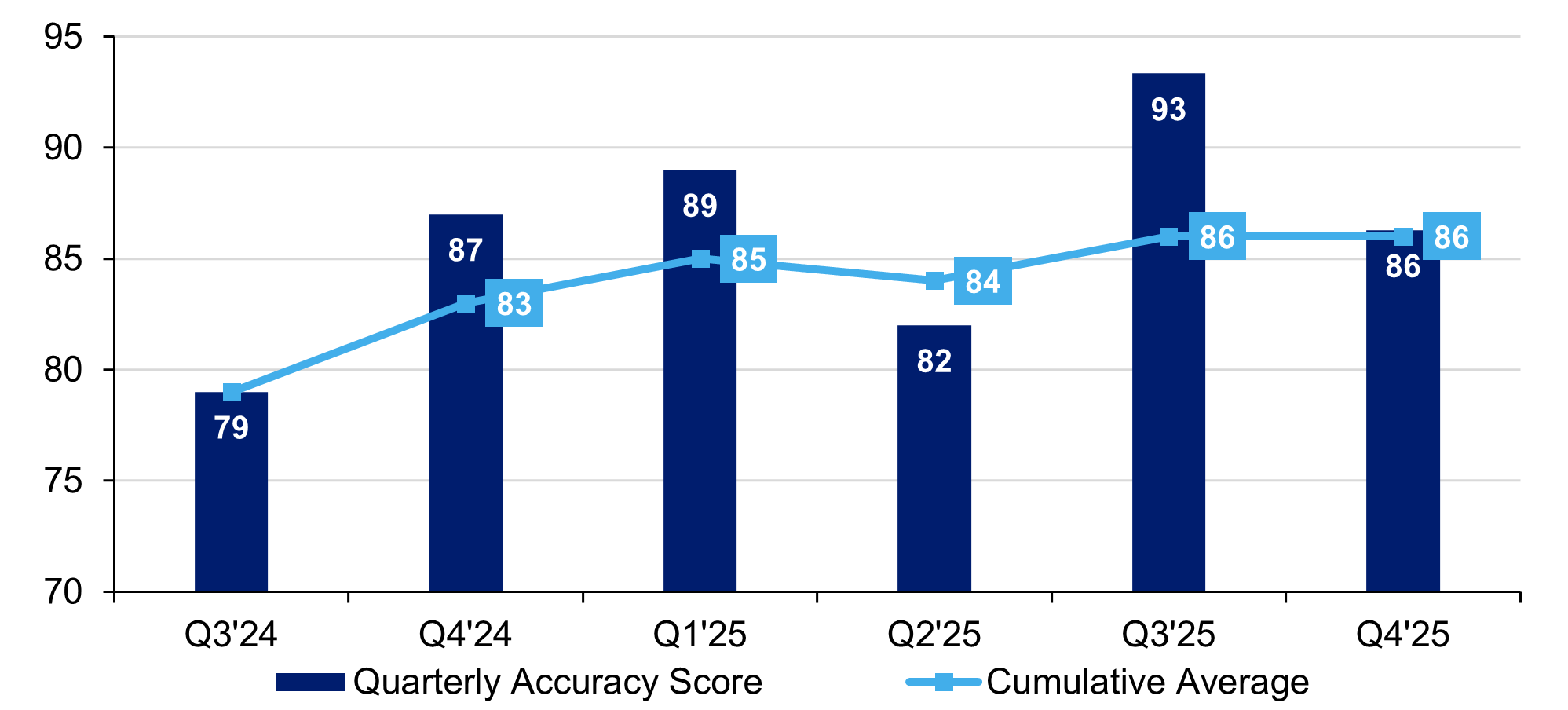

It’s important to emphasize that every rebalance is different. This is why we tend to put more weight on our cumulative average score as an indication of the efficiency of our approach, rather than focusing on the score from a single quarter. Figure 1 shows we currently have an average prediction score of 86, which is on the higher range of what could be reasonably expected with an investment process that is robust and consistent.

Figure 1: MSCI rebalance prediction history

Source: L&G – Asset Management, America. Data as of January 26, 2026.

Our latest predictions

Figure 2 highlights our predictions for the first-quarter 2026 MSCI rebalance. The key dates for this cycle are the following:

- 10 business day window: January 16 - January 30

- Announcement: February 10.

- Implementation point: Close of Friday, February 27, but may be different for some markets (e.g., market holiday, exchange closures)

Figure 2: Our MSCI predictions for Q1 2026

| Benchmark | Country | Name | Prediction |

|---|---|---|---|

| World ex USA | Austria | BAWAG GROUP AG | Add |

| World ex USA | France | AYVENS SA | Add |

| World ex USA | France | FDJ UNITED | Delete |

| World ex USA | France | EDENRED | Delete |

| World ex USA | Israel | TOWER SEMICONDUCTOR LTD | Add |

| World ex USA | Israel | WIX.COM LTD | Delete |

| World ex USA | Italy | TELECOM ITALIA-RSP | Add |

| World ex USA | Italy | NEXI SPA | Delete |

| World ex USA | Japan | SHIMIZU CORP | Add |

| World ex USA | Japan | IBIDEN CO LTD | Add |

| World ex USA | Japan | TOKYO METRO CO LTD | Delete |

| World ex USA | Japan | SG HOLDINGS CO LTD | Delete |

| World ex USA | Japan | TREND MICRO INC | Delete |

| World ex USA | Sweden | VERISURE PLC | Add |

| World ex USA | United Kingdom | DCC PLC | Delete |

| World ex USA | United Kingdom | HIKMA PHARMACEUTICALS PLC | Delete |

| USA | United States | IREN LTD | Add |

| USA | United States | FTAI AVIATION LTD | Add |

| USA | United States | COHERENT CORP | Add |

| USA | United States | AST SPACEMOBILE INC | Add |

| USA | United States | CURTISS-WRIGHT CORP | Add |

| USA | United States | LUMENTUM HOLDINGS INC | Add |

| USA | United States | CASEY'S GENERAL STORES INC | Add |

| USA | United States | BXP INC | Delete |

| USA | United States | JM SMUCKER CO/THE | Delete |

| USA | United States | ALEXANDRIA REAL ESTATE EQUIT | Delete |

| USA | United States | AMERICAN FINANCIAL GROUP INC | Delete |

| USA | United States | BAXTER INTERNATIONAL INC | Delete |

| USA | United States | PAYCOM SOFTWARE INC | Delete |

| USA | United States | ESSENTIAL UTILITIES INC | Delete |

| USA | United States | BOOZ ALLEN HAMILTON HOLDINGS | Delete |

| USA | United States | DOCUSIGN INC | Delete |

| USA | United States | AMERICAN HOMES 4 RENT- A | Delete |

| USA | United States | BENTLEY SYSTEMS INC-CLASS B | Delete |

| USA | United States | NUTANIX INC - A | Delete |

Source: L&G – Asset Management, America as January 26, 2026. For illustrative purposes only.

Prediction process

We have designed and implemented a low active risk approach to capture outperformance created by index micro inefficiencies. In our investment approach, we target a variety of opportunities, one being rebalance predictions, where we model widely followed approaches to predict index additions and deletions. This predictive capability provides an opportunity for us to optimize portfolio adjustments before official index announcements, potentially enhancing returns. Here’s how it works for an MSCI rebalance:

- On a quarterly basis, MSCI will re-establish its market cap weighted index series using a publicly available methodology, which means it can be independently modeled with reasonable certainty.

- We identify which companies we believe will be reclassified between the Standard (Large + Mid Cap) indices and Small Cap indices.

- MSCI selects one of ten days at the end of the month prior to the actual rebalance to crystalize sizing classifications.

- A public notification of the changes happens approximately two weeks before the rebalance, with the rebalance happening at the end of the month (February, May, August, November cycle).

After the rebalance period ends, we evaluate our predictions based on the following method:

- Correct prediction (i.e., True positive; 1 point)—We assign ourselves one point for every accurate add or delete prediction.

- Incorrect prediction (i.e., False positive; -1 point)—One point is deducted for every prediction that is not ultimately added or deleted by MSCI.

- No prediction (i.e., False negative; 0 points)—No points are assigned or deducted for an add or delete that was not originally predicted.

- We add up the total number of points and divide it by the total number of adds and deletes implemented by MSCI to determine our Rebalance Accuracy Score. While we do not expect to achieve perfect accuracy, our aim is to maximize correct predictions and minimize mistakes. Accurately predicting this information in advance is knowing what trillions of dollars are likely to do before they do it.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.