Financing the AI Future

AI became a transformative force in tech starting in late 2022, shifting the industry from steady cloud growth and IT spending to an AI-driven revolution. This shift has sparked soaring demand for data center infrastructure and energy, fueled by the training of large language models (LLMs) and the anticipated expansion of AI inference and edge deployments—which, according to S&P Global Ratings, “seem to be at higher risk of being underestimated than overly ambitious.”

Over $1 trillion in AI commitments have been announced since 2024, with over $500 billion coming in the last two months. Most recently, Meta has raised a staggering $29 billion, with $26 billion reportedly from private credit. Companies like Meta are turning to private credit to fund the infrastructure needed to build frontier models. By securing private credit capital through a joint venture, Meta can fund this expansion with the operational flexibility offered by private credit markets while maintaining a very strong balance sheet.

The move is the latest, and one of the most dramatic, signs that the AI arms race has become so tremendously expensive that even the world's wealthiest tech companies are turning to outside financing for new and creative ways to fund their ambitions. As the scale and urgency of AI investment continue to accelerate, attention is now turning to future spending estimates and the necessary sources of financing to support this momentum in an environment where the need for capital is both vast and immediate. We believe private credit will play a crucial role in filling the projected AI financing gap, creating opportunities for investors even as the outlook for AI remains uncertain.

Sizing up projected AI spending

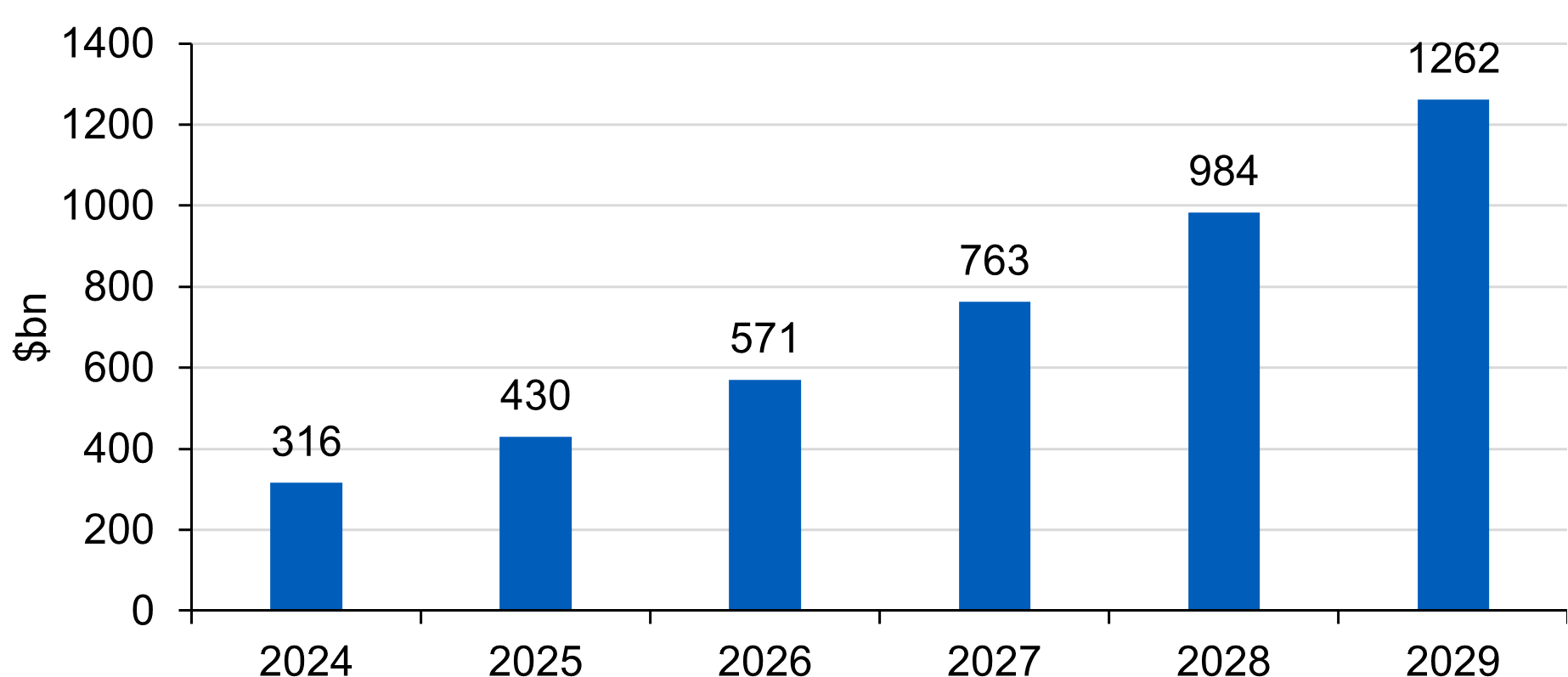

The transformative potential of the AI wave depends on large-scale capital expenditure, with data centers at its core. Currently, half of all commercial construction projects in the U.S. are data centers. And according to Morgan Stanley's predictions, global data center expenditure will reach approximately $2.9 trillion by 2028, of which $1.6 trillion will be for hardware (chips/servers) and $1.3 trillion will be for building data center infrastructure. On an annual basis, this means that investment demand in 2028 will exceed $900 billion. Independently, S&P cites IDC data suggesting the AI annual spend will reach $1.2 trillion by 2029 (Figure 1). For reference, the total capital expenditure of all companies in the S&P 500 Index in 2024 was only about $950 billion.

Figure 1: AI annual spend is projected to reach $1.2 trillion in 2029

Worldwide AI IT Spending Forecast

Source: IDC Market, S&P Global Ratings. Data as of September 30, 2025.

Capital expenditure on AI and data centers has been rising steadily, with spending by super-scale enterprises growing from $125 billion two years ago to around $200 billion in 2024 and expected to surpass $300 billion in 2025. Historically funded through internal operating cash flow, this model is becoming insufficient as investment needs surge. According to Morgan Stanley analysts' predictions, super-scale enterprises may have $1.4 trillion of capital expenditure funded by their cash flow, which will leave a financing gap of up to $1.5 trillion.

Filling the financing gap

The broad credit market will play a role as the most efficient provider of capital to fill this gap. The credit market, especially the private side, has a large and growing pool of disposable funds and offers attractive real yield, which is appealing to a sticky group of end investors seeking scalable, high-quality asset exposure that can provide diversified returns. Morgan Stanley estimates the scale of various financing channels as follows: private credit $800 at billon, private equity / venture capital / sovereign wealth at $350 billion, unsecured corporate bonds at $200 billion and securitized at $150 billon.

Private credit is currently at the intersection of a higher interest rate environment, significant asset expansion, and the complex, globalized and customized financing needs required for AI development. The opportunities for investors are expected in both the investment grade (IG) and sub-IG markets, with a large portion of the supply coming from IG entities.

Finding opportunities in IG

Large hyperscalers, REITs and utility / energy sponsors that enable AI prefer private, bespoke, long-dated debt (e.g., private placements, term loans and JVs) that won’t appear in the public bond market in the same form. Further, and most importantly, the massive investments come from IG companies. Amazon (rated AA), Microsoft (rated AAA), Meta (rated AA-) and Alphabet (rated AA+) have each announced multiple AI and cloud data center buildouts and power sourcing deals in the tens of billions over the next few years.

S&P Global Ratings notes that even if we experience slower-than-anticipated AI adoption amid the massive investments, they don't foresee a significant impact on these four big tech companies' credit ratings. These companies are still expected to generate substantial free operating cash flow, allowing them to keep their credit metrics well below their downgrade thresholds for their ratings. Their financial strength and the competitive advantages of their non-AI businesses—especially their distribution channels—enable them to outspend competitors and mitigate potential threats from emerging AI challengers. Given that first-mover advantages and technological leadership provide substantial competitive benefits, S&P expects these incumbents to continue investing heavily, proactively nurturing the AI ecosystem to facilitate faster adoption.

Outside of these names, in IG or sub-IG, S&P also notes that any ratings approach largely hinges on structural considerations, noting assets are not the primary differentiator (Figure 2).

Figure 2: Ratings approach outside of big four hinges on structural considerations

| Corporate Infrastructure | Project Finance | Asset-backed Securities | |

|---|---|---|---|

| Issuer | Corporate | Limited-purpose entity | Bankruptcy-remote special-purpose vehicle (SPV) |

| Construction Risk | Limited to expansion | May be present | Mitigated or limited credit |

| Operating Risks | Full exposure | Full exposure | Limited (transferable and replaceable) |

| Renewal Risk | Unmitigated (may have full market exposure) | Quantifiable (with impact on market exposure) | Quantifiable (re-leasing risk factored in) |

| Debt (Typical) | Senior secured or unsecured | Senior secured | Multi-tranche, secured |

| Creditor Protections | Typical corporate debt with limited covenants or security | Ring-fenced structure with covenants and security over assets, accounts, and key contracts | Ring-fenced with security over assets and/or cash flows, and ability to liquidate and sell |

| Debt Features | Short-/medium-term legal final maturity dates | Medium-term legal final maturity dates | Shorter anticipated repayment with longer legal final maturity dates |

| Refinancing risk | Refinancing risk allowed; assessment of maturity profile and liquidity | Refinancing risk allowed; reliance on operating cash flows | Refinancing expected but not mandatory at ARD; reliance on operating cash flows and liquidation value |

Source: S&P Global Ratings. Data as of September 30, 2025.

Navigating an Uncertain Outlook

AI remains credit-positive for leading tech companies, data center operators and power providers, but the sector faces growing risks as it matures—including competitive disruption, evolving pricing models, lease renewal uncertainty, the shift from model learning to inferencing, and constraints around power and permitting.

According to S&P, the most vulnerable are companies that have invested heavily but have yet to turn a profit, rely on external funding and operate in areas susceptible to rapid technological obsolescence. This includes firms such as OpenAI and Anthropic that focus on developing frontier AI LLMs and are increasingly investing in AI chip design and data centers. Despite experiencing exponential growth in valuation due to their AI models reaching unprecedented user adoption by certain metrics, their business models continue to evolve amid mounting losses and escalating ambitions.

The rapid rise of AI-driven investment has ushered in a new wave of supply, prompting a deeper reflection among investors: How will this influx reshape the landscape of debt channels, and where will it ultimately find its place? Private credit has emerged as a critical source of capital, helping bridge financing gaps and support continued innovation as traditional funding channels are tested by the scale and speed of AI investment.

While the long-term growth prospects for AI remain strong, the timing and scale of adoption—and the market’s capacity to finance it—remain uncertain. The evolving role of private credit will be central to navigating these challenges and sustaining momentum across the AI ecosystem.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.