Demystifying Private Credit Ratings

The bankruptcy of First Brands, an Ohio-based auto parts retailer, recently propelled private credit into the spotlight despite the asset class having a modest exposure to the company. It has also drawn attention to the unglamorous (but important) subject of credit ratings.

In recent months much has been written about the validity of private credit ratings, with musings on the capability of the credit rating agencies, particularly those outside the “Big Three” (that’s S&P, Moody’s and Fitch).

We therefore thought it was timely to provide some insight into how we navigate the complexities of private credit ratings.

Not all private credit is the same

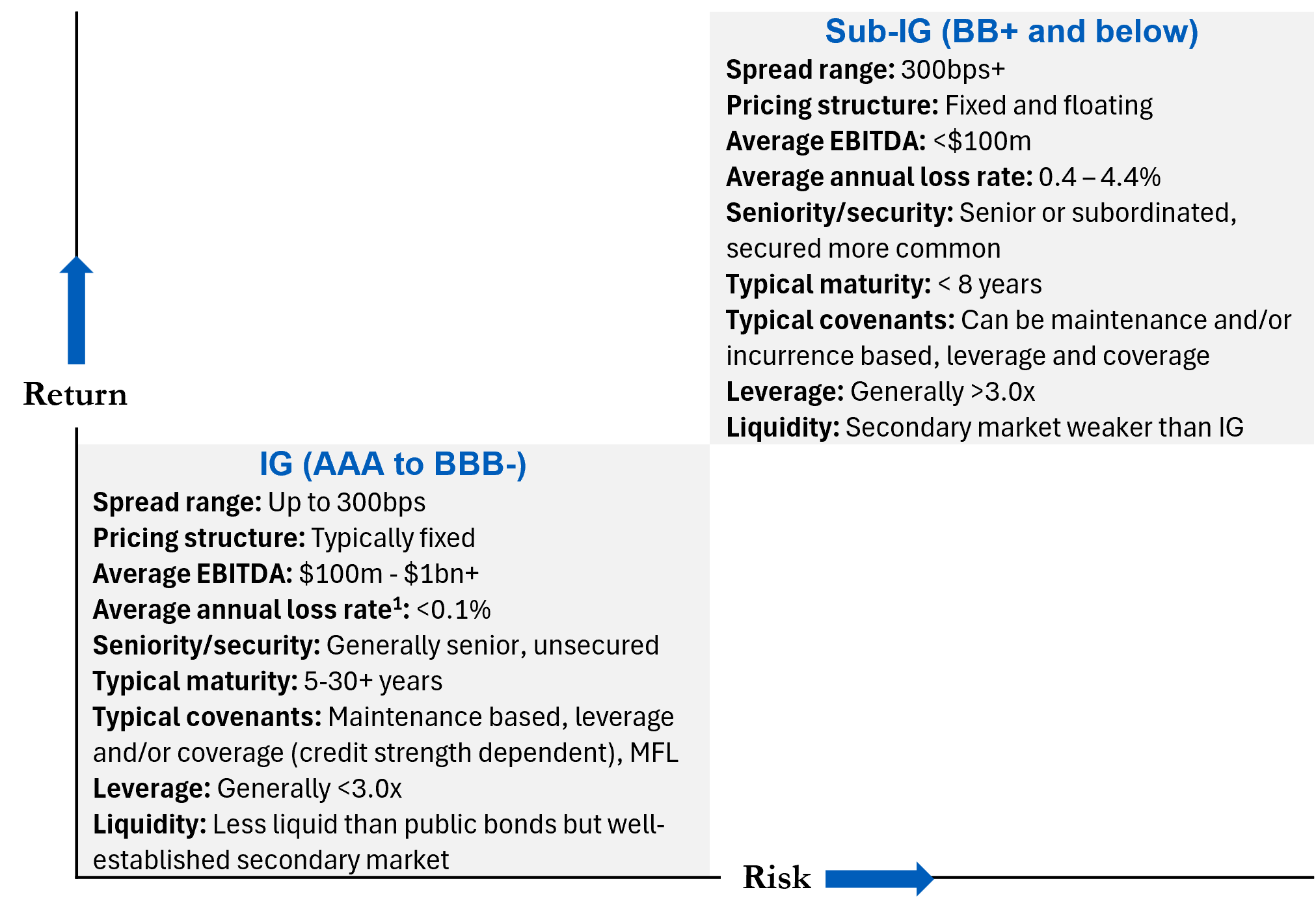

When people use the term “private credit,” they often mean the sub-investment grade (sub-IG) part of the market, which is dominated by direct lending. This segment grew rapidly in the aftermath of the global financial crisis. Investment-grade (IG) private credit, in comparison, is a less spoken about segment of the private credit market that has a track record over several decades. In terms of market size IG and sub-IG private credit are roughly the same at around $1.5 trillion-$2 trillion each based on our estimates.

Below we have used characteristics of corporate private credit to highlight the typical differences between IG and sub-IG. However, it should be noted that a large part of the IG private debt market is also asset-backed, including, for example, real estate debt, infrastructure debt and other structured or alternative finance.

Figure 1: The potential yield pick-up of enhanced LDI

Source: L&G, 2025. Moody's Global Annual Default Study 2024, data reflects the 10-year average annual loss rate from 2015 to 2024 for both public and private debt assets. Maintenance covenants are contractual obligations in loan agreements or bond indentures that require the borrower to maintain certain financial ratios or conditions throughout the life of the loan. They are designed to protect lenders by ensuring the borrower remains financially healthy and capable of repaying debt.

Source: L&G, 2025. Moody's Global Annual Default Study 2024, data reflects the 10-year average annual loss rate from 2015 to 2024 for both public and private debt assets. Maintenance covenants are contractual obligations in loan agreements or bond indentures that require the borrower to maintain certain financial ratios or conditions throughout the life of the loan. They are designed to protect lenders by ensuring the borrower remains financially healthy and capable of repaying debt.

It is key to point out that there is a significant variety of risk profiles available in sub-IG credit, with big differences between BB vs. single B and below.

BB borrowers sit at the upper end of the sub-IG spectrum and exhibit stronger fundamentals, typically with lower leverage, more predictable cash flows and greater scale. Despite this, lenders still typically benefit from robust covenant packages and other protections. Many investors focus on either firmly IG or single-B credit profiles. As such, despite its attractive risk-return profile, BB credit is often under-served by institutional capital—we refer to it as the “forgotten middle.” While this market has historically been well served by bank lenders, capital and returns considerations for banks often mean issuers in this segment have a desire to diversify their funding sources.

Private credit ratings are not new

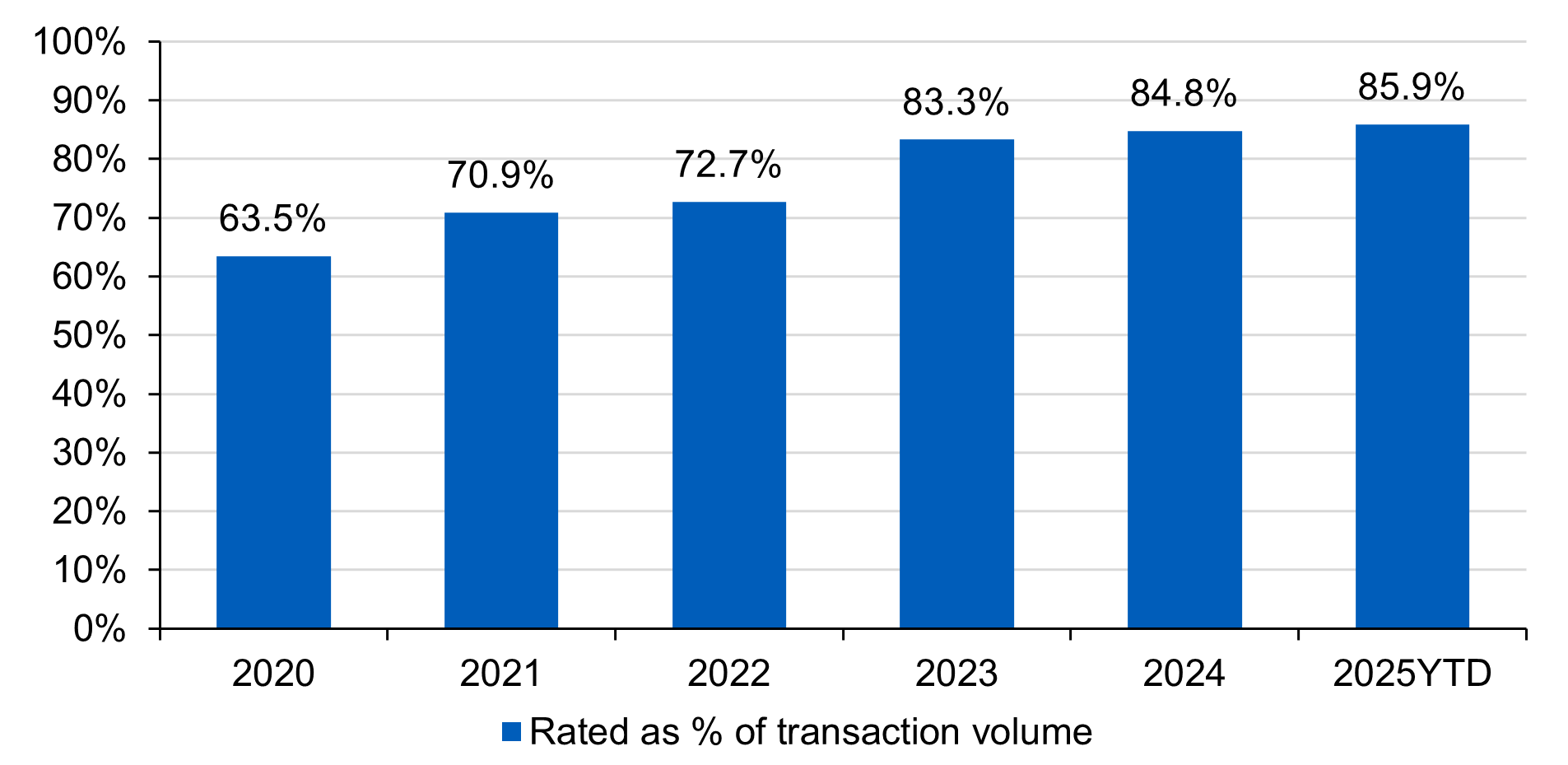

Insurers are a big investor in IG private credit due to the high credit quality and liability-matching characteristics. They also commonly require formal credit ratings for capital requirement purposes. This can be sourced from an external credit rating agency (NRSRO in the US) or from an internal ratings team.1 In 2024, roughly 85% of US private placements volume, which is a large part of the IG private credit market, had at least one external credit rating. Where the borrower has also issued debt in the public market, which is more common for IG than sub-IG, there will typically be a public credit rating available for the borrowing entity.

Figure 2: Rated as a % of transaction volume

Source: Private Placement Monitor, up to end of Q3 2025.

Source: Private Placement Monitor, up to end of Q3 2025.

Sub-IG private credit assets tend to be more bespoke, bilateral arrangements issued by smaller companies. It is less likely these companies would also issue in the public market and have a publicly available external rating. Some issuers will obtain a private rating from an external credit rating agency, but these are also less common in the sub-IG space, so lenders will often rely on their own internal rating assessments.

Sub-IG private credit is less popular with insurers, given the penal capital charges associated with assets with lower credit ratings. Institutional investors such as pension plans and endowments are the major allocators. Unlike insurers, they are not subject to regulatory requirements, although they are increasingly asking managers to provide credit rating data for portfolio monitoring and risk management purposes.

How credit ratings are assigned: Public vs. private

The methodologies and processes followed by external credit rating agencies to assign credit ratings remain the same whether the rating is public or private, the only difference lies in how the rating is disseminated:

- Publicly available credit ratings are freely accessible to all and published on the agencies’ websites without paywalls.

- Private credit ratings, on the other hand, are shared exclusively with a pre-selected group of investors, as permitted by the issuing entity and the relevant rating agency.

Unrated or non-recognized ratings

When a debt investment is either unrated or only rated by an external agency not recognized under the clients’ investment management agreements, in most cases L&G’s independent credit ratings team steps in to provide one. For internal ratings, the team uses proprietary rating methodologies and procedures designed to align broadly with external credit rating agencies to ensure consistency and avoid systemic bias. Most of the team have previously held roles at one of the major rating agencies.

Transparency is key

As we established earlier in this blog, there are two distinct parts of the private credit market, IG and sub-IG, which have very different characteristics. Private credit ratings are not new for either part of the market. Publicly available ratings are more prevalent in IG, but less seen in sub-IG, where internal credit assessments and private ratings from external credit rating agencies are more common. Private credit ratings thus play a vital role in supporting investor confidence and risk management. We believe transparency is fundamental to the credibility and effectiveness of the ratings. As private credit continues to grow and becomes more complex, robust and transparent rating practices remain essential for making informed investment decisions.

Lushan Sun, Head of Cross-Asset Research, Private Markets, L&G – Asset Management; Kyle McGibbon Senior Investment Specialist, L&G – Asset Management; and Dan Dreher, Solutions Strategist at L&G – Asset Management, America, contributed to this blog post.

1. NRSRO stands for Nationally Recognized Statistical Rating Organization. They refer to an organization that provides credit ratings for entities such as corporations, governments or financial instruments. The most well-known agencies are S&P, Fitch and Moody’s.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.