CIO Insight: AI Comes for Fixed Income Markets

The AI revolution will be debt funded, with a wave of issuance in public and private markets expected. We believe it’s not a question of which type of fixed income will see the supply increase. All debt markets are likely to be tapped.

AI is the topic du jour, with concerns about bubble risk dominating headlines. Yet we find AI capex does not look overly aggressive compared to prior episodes of technological revolution. Past capex super-cycles have been larger, and we expect increased spending as a percent of GDP going forward. A recent McKinsey report sees nearly $7 trillion of hyperscaler capex through 2030 ($5.2 trillion for AI and $1.5 trillion for non-AI). Morgan Stanley estimates $3 trillion over three years, while EpochAI estimates that the cost of the most expensive data center could reach $100 billion by 2027. Even with hyperscalers still funding a healthy portion from their free cash flow, the implication is $500-800 billion of additional debt annually—or $2-3 trillion cumulatively by 2030.

Last year was likely inflection point, where companies transitioned from self-financing to more reliance on debt markets, spreading AI-related risks more broadly across the economy. Now, 2026 could experience a record percentage increase in net supply. Over the past decade, the US non-Treasury bond markets grew $1.5 trillion annually, according to Bloomberg data. Adding $500-800 billion would boost net supply by 30-50%, our calculations indicate, pushing the total above $2 trillion for the first time and setting a record for the largest year-over-year percentage increase going back a decade.

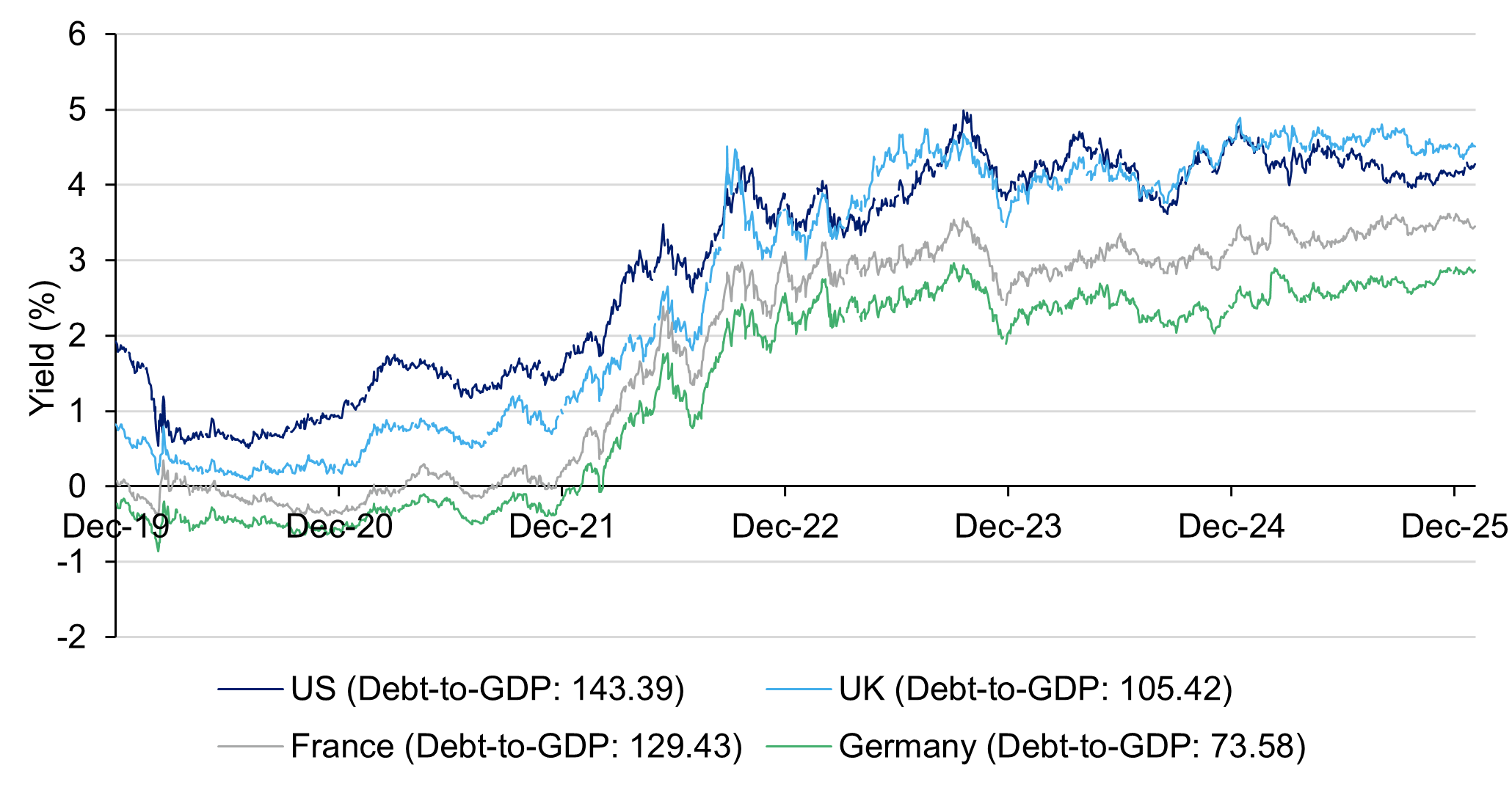

We believe that supply pressure from continued AI-driven capex issuance will remain a dominant theme in 2026, putting downward pressure on valuations for hyperscalers. Perhaps more importantly, this step-change increase in fixed income net supply—a glut of duration after a drought—comes amid rising government spending, and its impact is unlikely to be confined to tech. Most advanced economies are facing sluggish growth and elevated debt levels. AI debt will need to compete with government deficits—and the bond markets are already showing signs of discontent.

Figure 1: Bond markets are showing signs of discontent

10-year government bond yields (and debt-to-GDP)

Source: Bloomberg, L&G – Asset Management, America. Data as of January 31, 2026.

Disclosures

Unless otherwise stated, references herein to "LGIM", "we" and "us" are meant to capture the global conglomerate that includes Legal & General Investment Management Ltd. (a U.K. FCA authorized adviser), Legal & General Investment Management America, Inc. (a U.S. SEC registered investment adviser) and Legal & General Investment Management Asia Limited (a Hong Kong SFC registered adviser). The LGIM Stewardship Team acts on behalf of all such locally authorized entities.

This material is intended to provide only general educational information and market commentary. Views and opinions expressed herein are as of the date set forth above and may change based on market and other conditions. The material may not be reproduced or distributed. The material is for informational purposes only and is not intended as a solicitation to buy or sell any securities or other financial instrument or to provide any investment advice or service. Legal & General Investment Management America, Inc. does not guarantee the timeliness, sequence, accuracy or completeness of information included. Past performance should not be taken as an indication or guarantee of future performance and no representation, express or implied, is made regarding future performance.

Certain of the information contained herein represents or is based on forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Forward-looking statements and information are inherently uncertain and actual events or results may differ from those projected. Therefore, undue reliance should not be placed on such forward-looking statements and information. There is no guarantee that LGIM America's investment or risk management processes will be successful.

We have more blogs to share

Visit our blog site to explore our latest views on markets, investment strategy and long-term themes.